In William Shakespeare’s Hamlet, royal councillor Polonius advises his son Laertes, who is leaving Denmark for France, to “neither a borrower nor a lender be, for loan oft loses both itself and friend, and borrowing dulls the edge of husbandry.”

Polonius’s exhortation, while perhaps well-meaning, would have rendered him ill-equipped to be an investment manager in modern times. So how can investors effectively allocate to credit to build better portfolios?

Credit exposure can be effectively incorporated into any investment portfolio – and many of the most successful pools of capital over the very long term have been banks, life insurers, and other lenders who properly manage risk and who prudently reinvest or distribute income as conditions warrant.

In fact, for much of their existence most US pension plans were required to adhere to “legal lists” of acceptable investments, which consisted almost exclusively of government and low-risk utility-company and railroad bonds.

For example, CalPERS, the largest US public pension plan and my first investment-industry employer, was established in 1931, but couldn’t invest in equities until 1966, and was limited by law to a 25 per cent equity exposure until 1984.

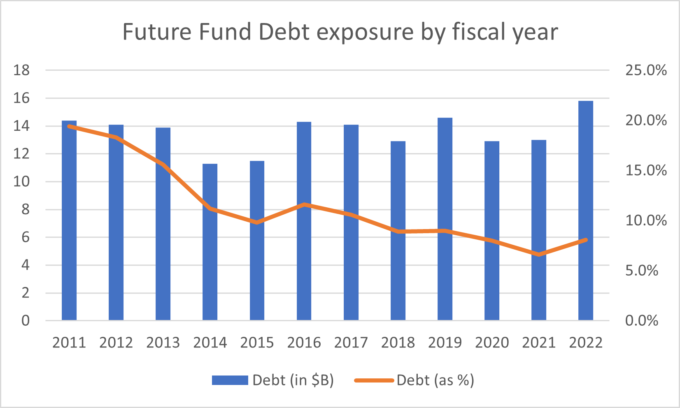

The question of “whither credit” is particularly apt in an era of rising interest rates and concern about future equity returns. To use an example from personal experience, the Future Fund’s exposure to Debt from fiscal 2011 to 2022 declined from nearly 20 per cent to around 8 per cent – a reflection of the Future Fund’s “house view” about the relative returns of credit relative to other asset classes. (If liquidity is plentiful and lending yields are low, it’s generally better to be a borrower than a lender!)

Even the increase in exposure in fiscal 2016 was the result of reclassifying some distressed debt portfolios from Alternatives to Debt. But as capital has become scarcer, credit may be an increasingly important part of a well-managed portfolio.

Source: Future Fund portfolio updates and annual reports

“Total portfolio” approaches are a topic of discussion among asset owners around the globe, and for good reason. Many investors have found a strategic asset allocation approach to be overly confining and an invitation to place investments, and investment teams, into silos. Optimising lots of different sub-portfolios often results in a sub-optimal total portfolio with sub-optimal outcomes.

How an investor implements a total portfolio approach will depend upon its resources, culture, and governance model, but all investors can benefit from total portfolio thinking.

Here I’ll introduce four lenses through which one can view credit in a total portfolio framework – one economic, one risk-management, one “regulatory,” and one cultural.

Credit and The Economic Lens

Here’s the irony of using equity as the primary return driver for a portfolio: most investors have a return target (a nominal 7 per cent, or inflation plus 4 per cent, or something similar) – yet they tend to use equities, which have fairly volatile cash flows and valuations, as the core risk-bearing exposure.

In many cases there are good reasons for this approach, but credit can at least provide a starting point that says “if we lend this much capital in this manner, and there are no defaults, then we exceed (or fall short of) our return target by x per cent.”

Overlaying an assessment of economic conditions to that starting point can then help sharpen estimates and think about alternatives. If, for example, one assumes that defaults in high-yield corporate credit will exceed historical averages, thus reducing returns, what else might be happening economically? And how might those economic conditions impact other parts of the portfolio?

Credit and The Risk Management Lens

The Future Fund tends to think about total portfolio risk through a few key metrics, the most prominent of which is equity-equivalent exposure, or “EEE.” Other key risk parameters include currency exposure, interest rate risk (real and nominal), and liquidity, among others – and some of these parameters will themselves play a role in EEE calculations based on their correlation with equity results.

The question “how much EEE is in a dollar of credit” is worth contemplating – equity and credit are obviously linked, but the different payoff profiles of each asset class require nuanced analytical approaches to effectively measure the risk. Investors’ individual goals, constraints, and biases will clearly play a role in this assessment.

Credit and The “Regulatory Capital” Lens

The introduction of performance tests such as Your Future, Your Super and the continued focus on fees mean that super funds are, more than ever, being forced to think about their portfolios relative to benchmarks and peer groups. Let’s leave to the side for the moment whether this framework is good for clients and think about what this means for an allocation model.

Attendees at the [i3] Insurance Investment Forum in Sydney in June got the chance to hear Richard Allen from life insurer TAL discuss a variety of investment strategies to mitigate inflation risk. Each strategy has to carry its weight from an economic perspective (for example, how effectively do inflation-linked bonds mitigate inflation-related risks) and a regulatory capital perspective (for example, does a portfolio of investment-grade credit with an inflation swap overlay generate a satisfactory return per unit of regulatory capital).

Banks and insurance companies have always had to invest with a regulatory capital lens; superannuation funds are now being called upon to do something similar. A credit portfolio may have significant tracking error to a YFYS benchmark, and that tracking error may be thought of as “regulatory capital.” Perhaps one way to mitigate this risk would be to use some of the income generated by the credit exposure to purchase options linked to the relevant YFYS benchmark. (This is not financial advice!)

Credit and The Cultural Lens

Smaller investment organisations often have teams of investment generalists tasked with identifying opportunities across the spectrum. Their limited resources more or less are the necessity which serves as the mother of invention, and the ability to “think like a CIO” is valuable. As organisations grow, so do silos. It takes real intent and effort to break down silos and prioritise joined-up portfolio thinking, but the value can be great.

If you’re meeting a middle-market private equity manager, bring a private debt-orientated colleague along. If you’re investing in structured credit, talk to the investment-grade credit team. Work with managers who invest across the capital structure and have incentives to see the best risk-adjusted returns regardless of whether the investment is equity or debt. And so on.

Any faulty effort to begin a piece with a line from Shakespeare should be bookended by an even worse attempt to make what we do look erudite. So, when it comes to credit, perhaps one can see Hamlet’s contemplation “to be or not to be” as a suggestion he was thinking of credit ratings: BB or not BB…

Craig Dandurand is Chief Investment Officer of the Tuckwell Family Office. Previously, he was Head of Debt for the Future Fund, while he also spent 13 years at CalPERS, where in his last role he was Portfolio Manager, Absolute Return. His views are his own.

__________

[i3] Insights is the official educational bulletin of the Investment Innovation Institute [i3]. It covers major trends and innovations in institutional investing, providing independent and thought-provoking content about pension funds, insurance companies and sovereign wealth funds across the globe.