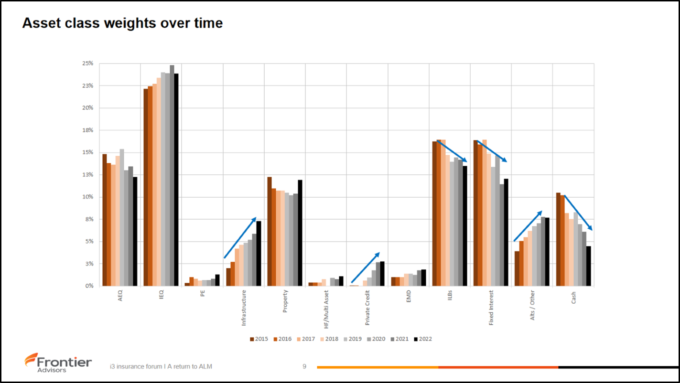

Research by Frontier Advisors into 11 Australian government insurance schemes shows the trend to diversify into unlisted and alternative assets is likely to continue

Only 18 months ago, many investment teams within insurance entities were looking towards private markets and alternative assets for yield, as bond rates were still at historic lows and provided little yield to cover their liabilities.

Their investment strategies went from one where liabilities were closely matched to one with more of an absolute return focus.

But as COVID-19 hit and central banks responded to the subsequent rise in inflation, bond yields have become attractive again. The Australian 10 Year Government Bond has a yield of 3.97 per cent, as of 21 June 2023.

The question this poses is whether insurance companies will return to more of a liability-matched model now that yields are attractive again?

Elie Saikaly, Principal Investment Consultant and Head of LDI & Government Investors for Frontier Advisors, tackled this question for the [i3] Insurance Investment Forum 2023 and looked specifically at the past and potential future allocations of long-tail, government insurance schemes.

Saikaly analysed over 80 annual reports and financial statements of 11 Australian insurance schemes over the period 2015 – 2022. The size of the schemes ranged from $20 billion to less than $1 billion with the average coming in at $7 billion.

Based on these observations and those with other asset owners more broadly, I anticipate that government insurers will need to manage growth in liabilities, new classes of claims and potentially higher levels of superimposed inflation

He concluded that many of these entities were likely to continue on the path of a more diversified portfolio with a higher allocation to private market and alternative assets.

“Based on these observations and those with other asset owners more broadly, I anticipate that government insurers will need to manage growth in liabilities, new classes of claims and potentially higher levels of superimposed inflation,” he said.

“A liability matched approach won’t suffice in this uncertain environment.”

Article continues below

Based on publicly available data of the various entities, Saikaly expected to see infrastructure gaining a bigger share of portfolios at the expense of property, with the exception of certain subsectors of the property market.

“Needs based property, such as BTR (build-to-rent), life sciences and healthcare offers a better hedge than more traditional sectors,” he said.

Private debt should experience continued growth as the asset class gains more acceptance, Saikaly anticipated, while a higher allocation to traditional bonds and cash gives some degree of downside protection.

Inflation-linked bonds will always have a role to play, but given the low returns these bonds have provided in recent years perhaps to a lesser degree than before, he said.

Saikaly also expected to see a continued focus on active management, especially in equity portfolios, as the market environment remains uncertain and volatile.

“Of all the asset owner types, government insurers provide the ideal conditions for long-term partnerships with active managers given the lack of fee pressure, APRA regulation and patient capital,” he said.

“In fact, the contribution from active management in some asset classes has been material, especially for the larger asset classes such as equities and fixed income.”

Saikaly also pointed out that many of the alternative asset classes, including unlisted infrastructure, private debt, alternatives, private equity, do not have passive benchmarks and so insurers have no choice but to actively manage these assets.

Changing Allocations of Insurers

The analysis provided a clear view of how asset allocation within insurance schemes has evolved since 2015, driven in part by the low interest rate environment and changing claim experience.

Saikaly observed that among the 11 schemes, there was a shift away from traditional fixed interest, including domestic nominal and inflation-linked government bonds, which was offset by higher allocations to international equities, unlisted infrastructure, private debt and alternatives.

Source: Frontier Advisors

“There has been a clear shift, not too dissimilar to other Australian asset owners, towards other sources of inflation hedging or floating rate exposure,” he said. “This has largely taken place in an environment of falling inflation, bond yields and cash rates.”

Saikaly acknowledged that he had to make a number of assumptions regarding the allocation to inflation-linked bonds due to the lack of data available, but believed there was a downward trend in allocations to these bonds.

The research also showed a growing preference for international over domestic equities among insurance investors, something that Saikaly believed is likely to continue into the future.

“While there is no benefit from franking credits, I wonder if this will persist, especially given the Australian equity market’s exposure to commodities and banking stocks versus US large cap technology stocks,” he says.

There has been a clear shift, not too dissimilar to other Australian asset owners, towards other sources of inflation hedging or floating rate exposure

Looking at the funding levels of the various organisations, the research showed that compulsory third party (CTP) schemes were the most stable of all the insurance schemes due to the lower variability of their claims profile.

Workers compensation schemes, on the other hand, faced some significant challenges from rising healthcare and rehabilitation costs, and also from a shortage of healthcare workers. Newer and growing classes of claims, including silicosis and mental health, added further pressure on these schemes.

“These latter claims can bear a much higher cost per claim than physical workplace injuries,” Saikaly says. “Some schemes have been very proactive in identifying preventative measures around mental health, but the result of long covid lockdowns in some states are beginning to show,” he said.

In the face of this, some schemes are raising premiums and investigating ways of improving investment returns, he said.

But all schemes, except for one, showed funding ratios that were within or even above their target ranges.

__________

[i3] Insights is the official educational bulletin of the Investment Innovation Institute [i3]. It covers major trends and innovations in institutional investing, providing independent and thought-provoking content about pension funds, insurance companies and sovereign wealth funds across the globe.