In January, investment veteran Pranay Gupta openly questioned the longevity of stock markets, arguing that if the ownership of stocks moved to a blockchain, the world wouldn’t need as many trading platforms as we have now.

But the Australian Securities Exchange’s (ASX) efforts in adopting blockchain are more modest. It isn’t aiming to trade securities over a blockchain system; it is looking to simplify the way it communicates with its end users.

Every day, the ASX handles $5.6 billion worth of equity trades and after every trade the buyer and the seller compare trade details, approve the transaction, change records of ownership and transfer securities and cash.

It is a series of exercises known as post-trade processing, a function currently facilitated by the exchange’s CHESS system.

“Effectively, what we are trying to do is to slide under the market a way to synchronise post-trade data,” Cliff Richards, Executive General Manager for Equity Post-Trade Services at the ASX, told delegates at the Australia-Korea Fintech Regulation Symposium 2019 hosted by the University of Technology Sydney last month.

“[We are looking] to find a way that if you are this custodian, you have the source of truth and you never ask the ASX what the source of truth is. You’ve got it and you can independently verify that what you have is the truth,” Richards said.

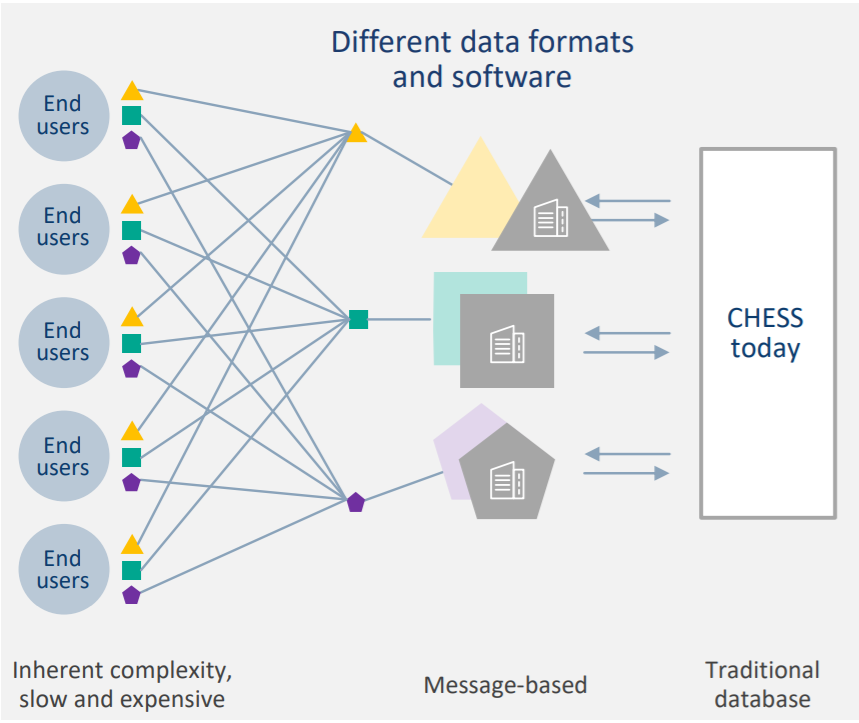

Currently, the end users face the problem that they use many different systems to communicate with the ASX, often using different programming languages, multiple entities and several databases.

To make all of this work is complex, time consuming and expensive. A blockchain solution would give participants the ability to reconcile their data without having to send messages to the ASX.

Current way of post-trade processing

Source: ASX

“If we can get the whole post-trade market to operate on a source of truth that they can independently verify is complete and accurate, then we can do something as a market that can’t be done today,” Richards said.

“This is the precondition of the application of automated workflows, or straight-through processing, not just within an entity … but we can start applying the standardisation or harmonisation of rules across the market and then workflows that will be compliant across the market.”

But to make this work requires a few tweaks.

A public blockchain is slow and has security issues, so the ASX will run a private distributed ledger with the help of United States technology company Digital Asset.

The choice of Digital Asset is largely tied to the company’s ability to solve security issues associated with two-way verification.

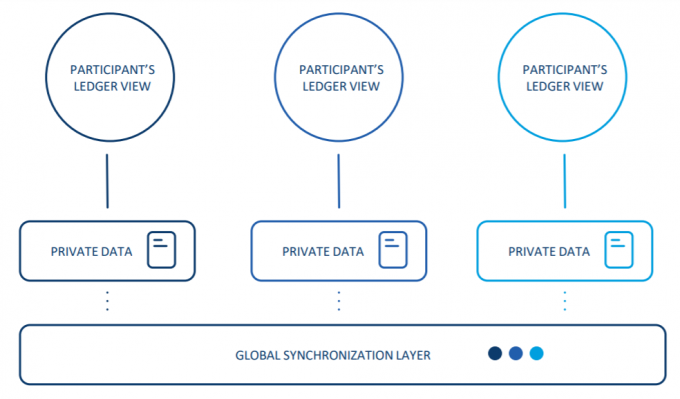

“What Digital Asset has brought to private commissioned blockchains, arguably earlier than any of the other private commissioned solutions, is that their architecture is heading towards what we would call a segregated data structure,” Richards said.

“What we are doing is separating out a so-called ‘global synchronisation layer’ from the private data of each participant.

“That is very important, because very early in the piece – early in 2016, when we were talking to the CIOs and CTOs of the global investment banks who are our clients – we asked them to be comfortable with a more classical blockchain description, which meant all data was replicated at every node. And that they should be comfortable with using two-way encryption to keep their data separated from their competitors.

“The logical question they asked was: ‘What about when that encryption algorithm is broken?’ Because everything in the system at every node is visible to every party that has that cracked encryption. And history tells us that even the best two-way encryption eventually gets cracked.

“So we came back to where we are today, which is segregating data, and the innovation here is an architecture that can stitch together a cryptographic log as a proof that the private data that is stored and segregated above it is in sync and is independently verifiable in sync.”

ASX proposed blockchain system

Source: ASX

Using an independent and verifiable log means end users can reconcile their data much faster, require less computer power to do so and still have a secure system in place.

“By segregating the blockchain, the data layer, into segregated data, we can be compliant today and tomorrow, hand over heart, with our privacy and confidentiality obligations,” Richards said.

The ASX won’t use the technology to tokenise any securities, since under Australian law electronic documents are recognised as valid contracts. “We are not tokenising anything because we had the advantage that our lawmakers changed all that 25 years ago,” Richards said.

The distributed ledger will replace the CHESS system, which is already 25 years old, but Richards made it clear this exercise is not about reducing cost for the ASX. It is meant to reduce complexity and speed up the post-data processing for clients.

“This is not the ASX seeing a huge opportunity to become much more efficient; we are already very efficient. This is about the overall market efficiency, efficiency for clients,” Richards said.

The application of blockchain in trading functions is still far off as current systems simply can’t deal with the volumes, he said.

“Seven transactions per second in Bitcoin, [while the ASX has] 2 to 3 million transactions a day that will need to be registered within a couple of seconds of them occurring. We cannot apply public blockchain in their current state. They just can’t handle the volumes,” he said.

“We believe that if we didn’t have a segregated data structure, if we had capacity issues and had to wait for the evolution of technology, then we would be looking at 10 years away from applying Ethereum-like public blockchains to capital markets with the volumes and values that we have.”

__________

[i3] Insights is the official educational bulletin of the Investment Innovation Institute [i3]. It covers major trends and innovations in institutional investing, providing independent and thought-provoking content about pension funds, insurance companies and sovereign wealth funds across the globe.