Climate risk, labour and human rights issues and board diversity are key areas of consideration among asset owners increasing their focus on environmental, social and governance (ESG) factors.

Evidence has started to show that investors can improve portfolio risk and return outcomes over the long term by incorporating ESG factors into their investment processes[1]. However the consideration of broader risks, beyond ESG factors, can also be useful in helping to design more robust investment portfolios and risk management processes.

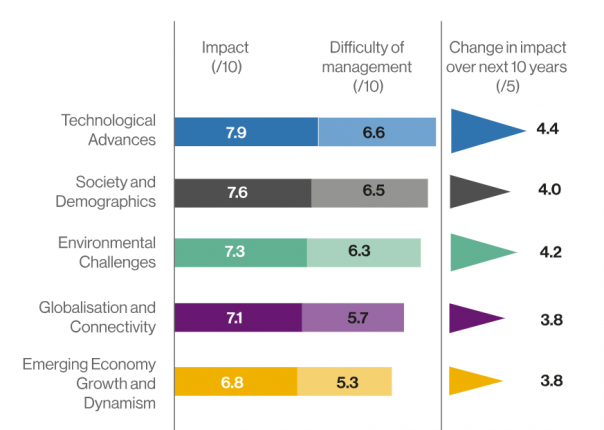

Willis Towers Watson’s Responding to Megatrends report, produced in conjunction with the PRI, identified five key megatrends, as well as 21 associated micro-trends. These megatrends are expected to alter the structure of economies, industry and capital markets. The five key megatrends (ranked by survey participants in order of importance) are shown below.

Figure 1: Megatrends Ranked By Potential Impact

Source: PRI & Willis Towers Watson

The highest ranked megatrend was Technological Advances, followed by Society and Demographics and Environmental Challenges. Clearly, technological advances have the potential to create sudden and significant changes in productivity and the economics of industries.

Analysis[2] conducted by the McKinsey Global Institute considered the potential for automation to impact the labour force for key employment sectors. The top 10 sectors included: manufacturing, agriculture, transportation, mining, construction and utilities. The labour productivity of these sectors are exposed to technological developments that can materially alter the industry dynamics in a favourable way. Yet, these are the same industries where exposure to carbon-related risks are most significant.

A well-meaning effort to limit exposure to carbon risk could also reduce the potential to benefit from technological breakthroughs that may have a greater economic impact. Managing a narrow set of meaningful risks in a portfolio can lead to an unintentional increase in overall portfolio risk.

With the Thinking Ahead Institute, Willis Towers Watson developed a three-step framework to help investors quantify the impact of sustainability risks on asset returns:

Step 1 – analyse megatrend impacts at the industry and/or asset level.

Step 2 – based on a given portfolio’s exposure to a particular sub-trend, use scenarios to manage material uncertainty, sensitivity-test the impact of assumed sustainability risks and build a picture of the likely effects on cash flow generation.

Step 3 – compare this analysis to current market prices by making use of a “what’s priced-in” framework to derive the fundamental conditions currently discounted in the prices of assets significantly exposed to the trend under examination. Take action where expectations differ materially from market prices.

The ultimate goal is to identify the direction and size of the impact of megatrends on specific portfolio exposures. Once a significant mispricing is found and investors have a clear understanding of why it exists, the best implementation option can be determined to take advantage of an under exposed opportunity or hedge an over exposed risk, with the end result being a more sustainable investment portfolio.

Louise Lew leads Willis Towers Watson’s sustainable investment capability in Australia. Louise is also a member of the investment strategy team.

Ken Liow is Principal of Obsidian Capital and advises a range of institutional investors.

[1] Willis Towers Watson; 2018; “Show me the Evidence”

[2] Chio M, Manyika J and Miremadi M; July 2016; “Where machines could replace humans – and where they can’t (yet)”, McKinsey Quarterly

__________

[i3] Insights is the official educational bulletin of the Investment Innovation Institute [i3]. It covers major trends and innovations in institutional investing, providing independent and thought-provoking content about pension funds, insurance companies and sovereign wealth funds across the globe.