Should liquidity be a risk that is managed at the executive level? [i3] Insights Editor Wouter Klijn explores the benefits of creating a Chief Liquidity Officer role.

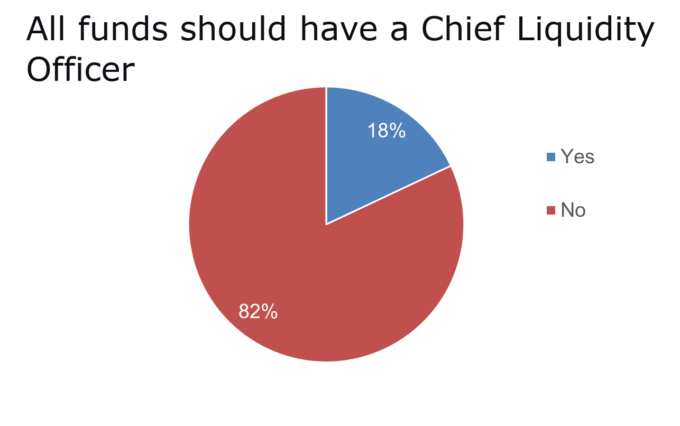

At our recent [i3] Investment Strategy Forum 2023 in Torquay, Victoria, we asked delegates whether they agreed that all funds should have a Chief Liquidity Officer (CLO).

The polling question preceded a debate between PGIM’s Bruce Phelps and Spirit Super Deputy Chief Investment Officer Philip Naylor on this issue.

In response to the question, 82 per cent of delegates said ‘no’.

Maybe I shouldn’t be surprised at the reluctance to create yet another role in the organisational hierarchy of an institutional investment organisation, but I was. After all, besides outright fraud, funds face two key extinction risks: poor performance and a liquidity crunch.

Poor performance has become a heightened risk with the introduction of the Your Future, Your Super performance test, but even under this measure it is likely to take several years for poor performance to filter through the test, which is based on eight-year rolling returns.

But liquidity crunches can be swift and deadly.

Source: Investment Innovation Institute [i3]

Although the chances of the equivalent of a bank run happening in a super fund is small, members do have the ability to move their account balance within 30 days, if they choose to do so, adding pressure on liquidity needs.

But liquidity risk is more likely to come other areas of risk, including member switching, capital calls by private equity or venture capital managers, FX hedging margin calls, or a curve ball in the form of yet another early release scheme, as happened during the pandemic when the government allowed members to withdraw $10,000 from their superannuation in two periods.

Or all of these events occurring at the same time.

Liquidity events are also becoming more impactful as many funds have increased their allocation to private market assets over the years, as expectations of public market returns diminished.

Institutional investors have also expressed concerns over periodic liquidity problems in credit markets in times of stress.

You could argue that heightened risks to liquidity justifies the appointment of a CLO.

The CLO would be responsible for not only monitoring current liquidity facilities and demands, but also for assessing what situations could arise that would threaten a fund’s liquidity position in the future.

A CLO would take a long-term view towards liquidity planning that manages the fine balance between the risks of a liquidity crunch and the performance drag caused by having too much liquidity.

Currently, liquidity is often monitored by a fund’s risk team and to a lesser degree its Chief Investment Officer, but it is usually not a dedicated function.

Critics have argued that the creation or yet another chief role is somewhat random and if you create a CLO, then why not a Chief Regulatory Risk Officer, or a Chief Member Switching Officer? And the list goes on.

But such risks are simply derivatives of the two key risks that a fund faces: poor performance and a liquidity crunch. Creating a C-suite role would elevate liquidity risk to the executive level, rather than merely adding another risk function to an existing team, giving it the gravitas it deserves.

The Australian Prudential Regulation Authority (APRA) has not yet called for the creation of such a role, but it has indicated that it will place more importance on liquidity in its oversight this year.

“APRA will … assess the preparedness of trustees to respond to investment market stresses, including possible liquidity stresses,” Margaret Cole, Deputy Chair of APRA, said in a recent speech.

AustralianSuper is also on board with this line of thought and in December last year it became the first Australian fund to create a CLO role, naming Joris Hillmann, Head of Capital Markets at AustralianSuper, as Acting CLO, while the fund was recruiting for the role.

The fund said the CLO was an acknowledgement of “the important role that managing liquidity plays in delivering on our purpose for members”.

The question is now whether enough funds will change their mind on the need for such a role and follow AustralianSuper’s lead?

Wouter Klijn

__________

[i3] Insights is the official educational bulletin of the Investment Innovation Institute [i3]. It covers major trends and innovations in institutional investing, providing independent and thought-provoking content about pension funds, insurance companies and sovereign wealth funds across the globe.

![Wouter Klijn, Director of Content at the Investment Innovation Institute [i3]](https://i3-invest.com/wp-content/uploads/2018/07/Wouter-Klijn-680-679x430.jpg)