While the market for commercial real estate (CRE) investments has globalised in recent decades, it doesn’t necessarily follow that the market for managing those cross-border CRE investments has globalised in tandem, Rohan Shan writes.

Barriers against successful domestic CRE fund managers attempting to go global remain ever present:

- The best deal flow always goes to domestic CRE managers in their home markets first – international managers only get the dregs that domestic CRE managers and their investors didn’t pick up – this alone is reason enough to invest cross-border with domestic CRE managers (and not international CRE managers)

- Ditto for information, the best private information flows to domestic CRE managers in international market first

- Domestic CRE best practices are not internationally portable – what worked outstandingly in one’s domestic market doesn’t necessarily translate in another market

- Domestic CRE managers who are parachuted into foreign markets to manage local hires tend to override local staff in decision-making when local staff have the better local market knowledge

- Domestic investors wanting to go abroad can readily access domestic CRE managers in international markets directly to manage their investments. Even if they manage to avoid charging an extra fee layer, what value proposition does the domestic CRE manager going into foreign market bring to their clients?

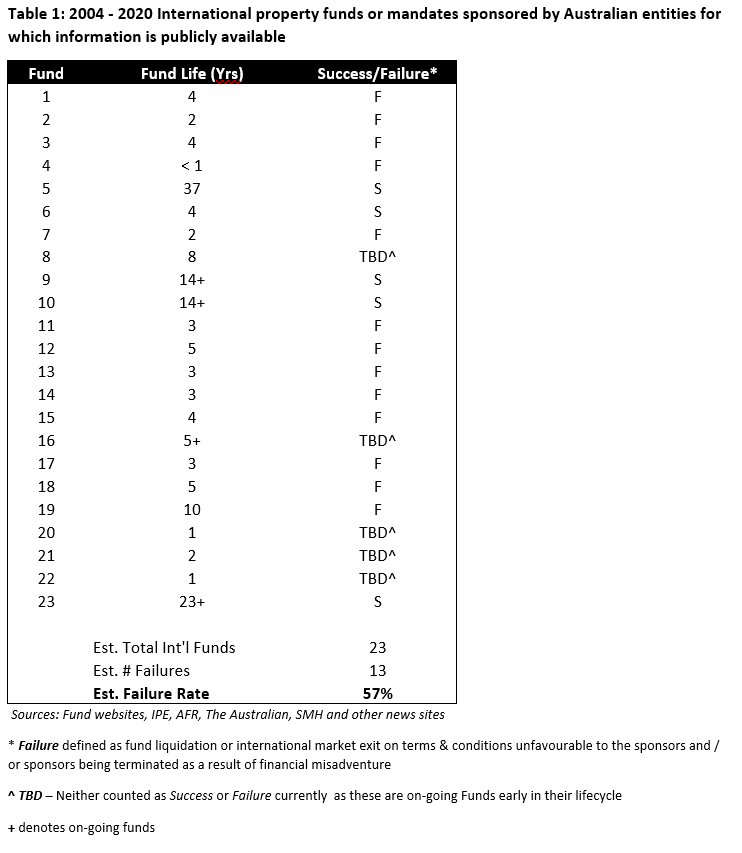

With an estimated historical failure rate in excess of 50 per cent, investors are better off flipping a coin than putting their dollars with Australian managers going abroad.

Lies, damn statistics and algorithms

The temptation for domestic CRE fund managers to go international is arguably greater today than in the past.

Hard entry barriers have fallen – foreign capital restrictions, transparency of international markets[1], legal and tax treatment of foreign investors have all improved in recent years.

“A lack of investment opportunities domestically is not a compelling enough reason (for Australian CRE fund managers as opposed to Australian capital – ed. note) to go offshore in our view,….We note many Australian Real Estate Investment Trusts have spent the last five years divesting offshore exposures taken on in the lead up to the global financial crisis.” – Macquarie Research (2015)

The availability of CRE data from international markets is more readily available today than in the past. Investment performance data which largely capture results achieved by domestic managers (ca. 90 – 100 per cent) in their respective home markets can provide the illusion that such results readily achievable by international managers attempting a toehold in these markets.

In previous work, I have estimated that the demand for core Australian CRE is greater than the supply for the foreseeable future thanks largely to the growth in compulsory contributions to superannuation. Some of that excess demand will spill over to core CRE abroad especially for larger Australian institutions.

This data is now being crunched by a younger generation of analysts hired by managers with little to no historical knowledge nor fully appreciate the limitations of that data which I’ve highlighted earlier. These data jockeys are highly numerate to boot but lack serious on the ground experience, adding to the risk of the data providing a false sense of confidence in managers’ ability to be successful abroad.

And another thing – even if you knew the names and incidents of cross-border manager failures past and tried researching them on the internet, they don’t turn up as frequently in the search results, if at all: Search algorithms are designed to bring up the latest and trending news articles first and bury those in the past on the 29th search page, if they haven’t been taken offline already.

If you remain unconvinced, consider the counter fact for which data does exist:

How many international managers have been as successful as established domestic CRE managers in your home market? To avoid survivor bias, don’t just count the ones operating today, but include the ones that have crashed in or exited your home market in the past.

So, as we recover from the Covid-19 equity sell-off and the pressure to sell illiquid asset classes subsides and reverses gear into pressure to buy, it will be telling to note which domestic CRE manager(s) will succumb to the hubris of thinking that what worked for them domestically will translate into cross-border success.

For now, travel restrictions continue to hamper due diligence for international assets and investment platforms – but for how long?

That path is littered by ghosts of Australian CRE fund managers past that went before them, failed miserably and destroyed investor and shareholder value in the process.

These ghosts are growing increasingly invisible to a new generation of managers, as industry veterans with war scars of going international exit the industry with little or no systematic program to pass on valuable industry knowledge and experience to a younger generation of inexperienced managers.

Rohan Shan is an independent consultant, based in Brisbane. Until 2019, Rohan spearheaded QIC Global Real Estate’s top-down investment risk and strategy research function. He oversaw QIC’s domestic and international property portfolios for over 12 years.

__________

[i3] Insights is the official educational bulletin of the Investment Innovation Institute [i3]. It covers major trends and innovations in institutional investing, providing independent and thought-provoking content about pension funds, insurance companies and sovereign wealth funds across the globe.

[1] https://www.jll.co.uk/en/trends-and-insights/research/global-real-estate-transparency-index/transparency-survey-highlights-2020