Cluster analysis is a good example of how machine learning can be practically applied to investment problems, a session at the Frontier Advisors Annual Conference showed. And the applications seem endless.

Last month, Frontier Advisors held its annual conference in quite a unique way. Hampered by the coronavirus pandemic, the asset consultant was forced to move its event online, but did so in an engaging way.

If you thought ‘Death By PowerPoint’ was an appropriate phrase, then try sitting through a full-day video conference. So instead of forcing people to sit through more than eight hours of individual sessions in a single day, Frontier spread out its sessions over a period of two weeks.

For me, it meant I logged into nearly every session of the conference.

There were many great sessions, including on how AustralianSuper picked a Chinese equity manager, liability-driven investing and geopolitics.

But for me the highlight was the last session of the conference.

In this session, Donna Davis, an associate with Frontier Advisors and a former options trader for AustralianSuper, discussed how cluster analysis, a form of unsupervised machine learning, could be applied to manager research.

![Wouter Klijn, Director of Content, the Investment Innovation Institute [i3]](https://i3-invest.com/wp-content/uploads/2020/08/Wouter-Klijn-Resized-for-Web-Square.jpg)

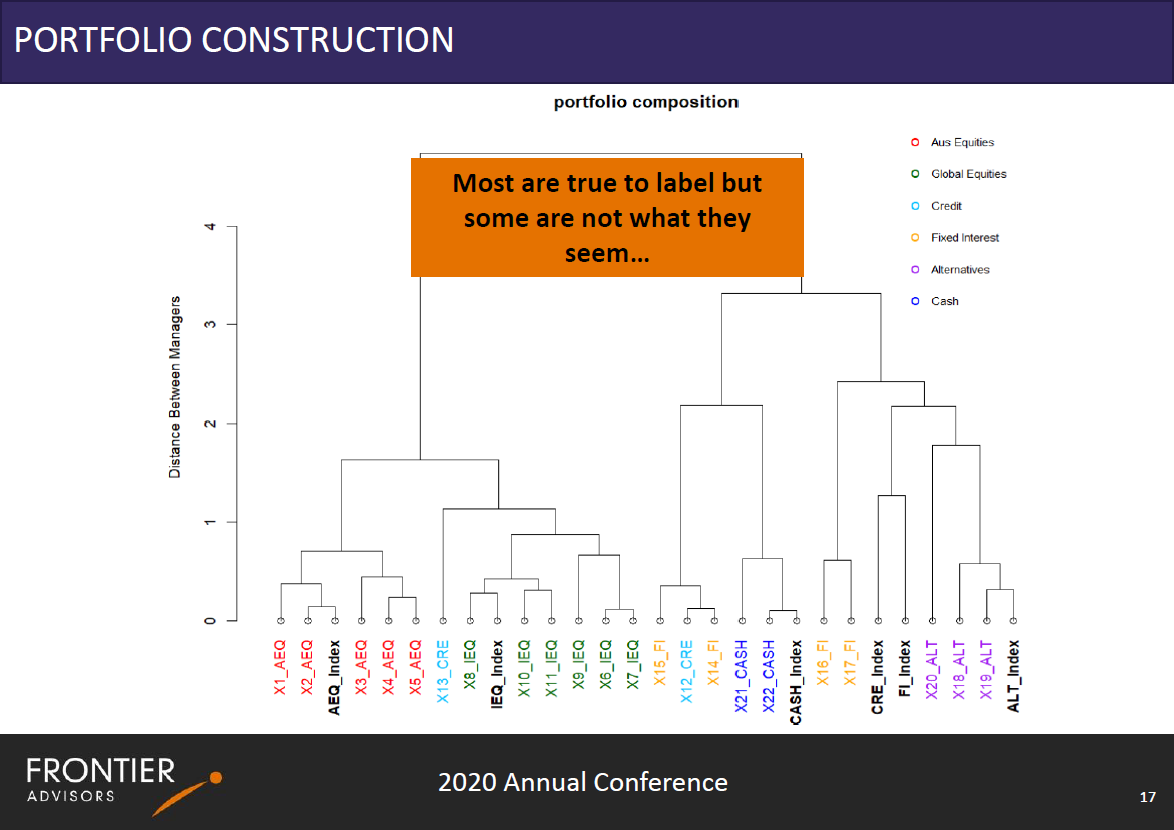

Davis showed how you could assess whether fund managers were true to label by analysing whether their strategies actually clustered around a relevant index. We are not talking about index hugging here, but merely about whether their portfolio had any relevance to the investment universe they were claiming to operate in.

In a fascinating presentation, Davis showed how you could assess whether fund managers were true to label by analysing whether their strategies actually clustered around a relevant index.

We are not talking about index hugging here, but merely about whether their portfolio had any relevance to the investment universe they were claiming to operate in.

Most managers in the data sample showed up where you would expect them to. For example, an Australian equity manager would pop up in a cluster that, besides other Australian equity managers, also included the Australian equity index.

But surprisingly, this wasn’t always the case.

Davis showed how one credit manager showed up in a cluster for international equities, while another credit manager seemed to have more in common with the cash benchmark than the credit index.

Some managers seem to have portfolios that correspond with a different universe than their label suggests, a cluster analysis by Frontier Advisors finds.

This might not be enough reason to disqualify a manager, but it certainly is a good starting point to ask some pointy questions.

The presentation was a great example of a practical application of machine learning. Stripped of all the hype, Davis showed how this method can deliver results that humans can’t.

Humans tend to be pretty bad at comparing more than two or three features at a time, let alone comparing the line items in portfolios of a group of 40 to 50 fund managers. Davis showed machines can do this.

After delivering her presentation, it was time for questions from the audience. Initially, the questions were about the method and assumptions Davis had made in her analysis.

But then something magical happened.

As an asset consultant, applying cluster analysis to the manager research process is an obvious choice. But could this method be applied to other investment issues?

One participant asked if cluster analysis could be applied to relative value trading strategies, to which Davis answered that this method definitely includes trade scenarios, and especially relative value because you are looking for offsetting trades.

In fact, a quick search online revealed people have been looking at cluster analysis to create cohorts of companies based on the fundamental characteristics of these businesses and assess whether there is a price differential that seems unjustified.

One mysterious paper from two anonymous researchers delves into the application of cluster analysis and machine learning in pair trading, a relative value trading strategy where an investor seeks to profit from the relative change in one stock or asset relative to another stock.

As more suggestions were made, David and Michael Sommers, who chaired the session, grew visibly excited.

Participant: “Is it possible to look at performance clustering during default cycles?”

Davis: “What a lovely question!”

Participant: “Have you looked at running this analysis over all of the MySuper products and see who is basically running a 70/30 fund and those that are doing something different?”

Davis: “We haven’t yet, but this is potentially a method of testing how true to label our MySuper options are!”

Participant: “Have you compared fundamental managers versus quantitative and do quantitative managers have a tighter cluster?”

Davis: “I would love to have a look at this!”

And the suggestions kept coming.

It is not often you see innovation play out right before your eyes, but that was exactly what was happening in this session.

We are only just beginning to understand how machine learning can help us become better investors, but whereas only a couple of years ago people were talking about driverless cars and drone deliveries, we are now increasingly seeing applications that are directly applicable to investment problems.

I, for one, am excited to see where this will take us.

Wouter

__________

[i3] Insights is the official educational bulletin of the Investment Innovation Institute [i3]. It covers major trends and innovations in institutional investing, providing independent and thought-provoking content about pension funds, insurance companies and sovereign wealth funds across the globe.