In March, the Australian prudential regulator released its long-awaited information paper on climate risk, which had been in the making ever since Geoff Summerhayes, Member of the Australian Prudential Regulation Authority (APRA), told the Insurance Council of Australia’s annual forum in 2017 that institutional investors had a responsibility to address these risks.

The information paper lays out in clear terms how the prudential regulator defines climate risk and which areas it wants investors to focus on.

Climate risk can be split into three areas, the regulator argues: physical risk, transition risk and liability risk.

Physical risk includes, for example, damage to assets or properties from extreme weather events, while transition risk focuses more on the move away from fossil fuels and the challenges of holding stranded assets.

Liability risk homes in on the risk of litigation that might be brought forward when a company fails to address climate risks.

At the Investment Innovation Institute, we decided to ask delegates at our annual Insurance Investment Forum, which was held in June, to tell us how they see climate risks and what they are doing to address these.

The audience consisted of senior investment professionals, who together represent most of Australia’s largest insurance companies, and so polling them would provide a pretty good idea of how the Australian insurance sector perceives these issues.

This exercise provided some unexpected findings.

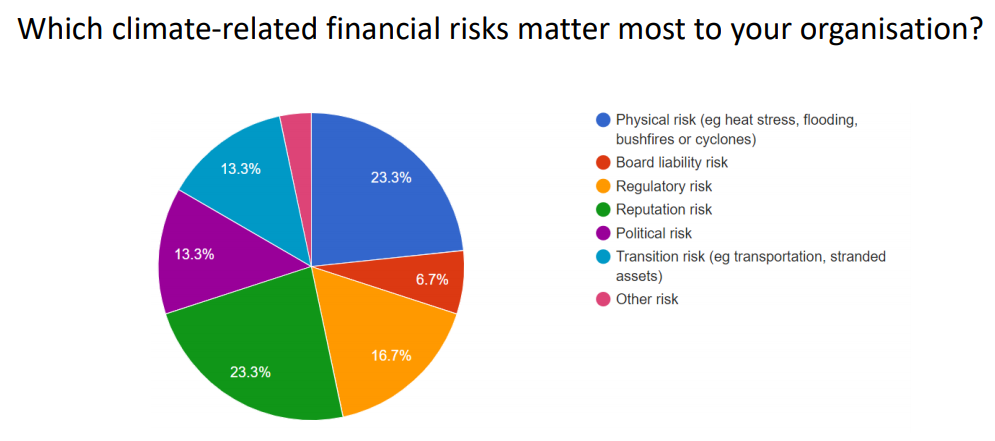

First of all, we asked them about the three areas of risk and wanted to know which of these risks they are most concerned about.

The response showed a far greater variation than you might expect from organisations that occupy the same sector.

From the above chart, you can see insurance companies are more concerned about physical risks than about the risk from the transition to a low-carbon economy. Perhaps this reflects the practicalities of insurance contracts.

But you can also see there is simply little agreement on what risks are most relevant to the sector.

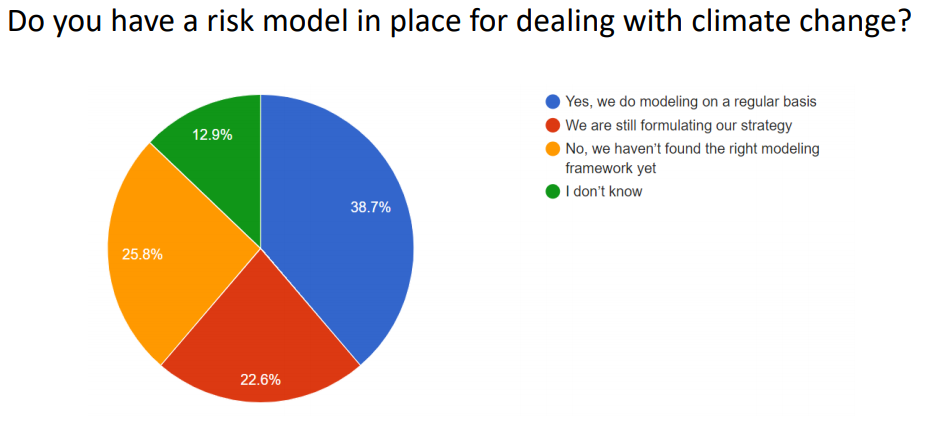

Then there was also some variation in the level to which insurers have measures in place to track and manage climate risks.

Although almost 40 per cent said they model risks stemming from climate change, still one-quarter of respondents admitted they hadn’t yet found the right way to deal with this. A similar number were still in the midst of formulating a strategy, while 13 per cent simply had no idea what was going on.

The APRA paper shows that especially life insurance companies seem to be lacking in their awareness of, let alone have a response to, climate risks.

But during the forum, it became clear life insurers aren’t as unaware as initially thought. Instead, they argued that although the risks from climate change are real, these risks don’t (yet) affect the average lifespan of people and, therefore, have a benign effect on their business.

They were much more concerned about developments such as the rise of viruses resistant to antibiotics and the increasing number of anti-vaxxers, both which have a direct effect on longevity. Such issues are much more relevant for life insurers than climate change.

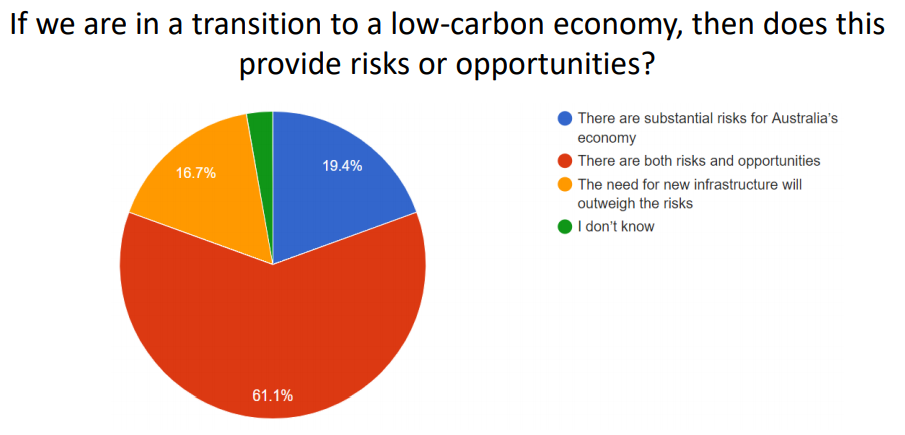

Besides, it is not all doom and gloom. Asked if the transition to a low-carbon economy would provide merely challenges, the audience responded more measuredly and argued there would also be opportunities stemming from new growth areas, including technology and education.

APRA says it doesn’t plan to add prudential standards that would prescribe minimum expectations specific to the management of climate change risks. The regulator argues the existing prudential framework already caters for addressing these risks, especially through CPS 220 and SPS 220.

But APRA will be embedding the assessment of climate risk into its supervisory activities and will assess the effectiveness of risk identification, measurement and mitigation strategies adopted by all regulated organisations.

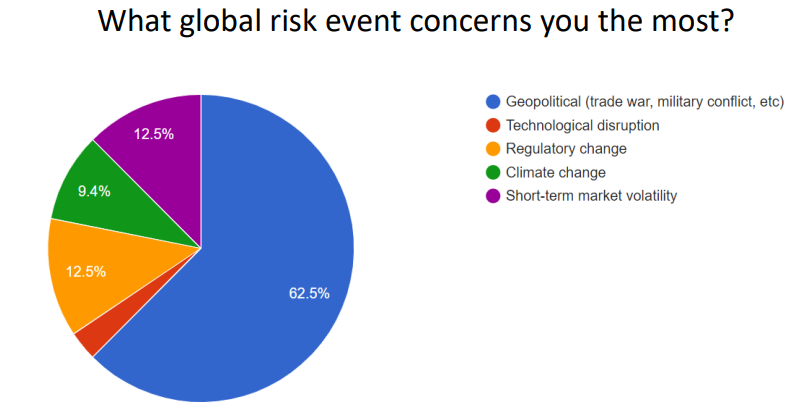

Although climate risk seems to be on the radar of most investment teams within insurance companies, it wasn’t top of mind for most.

More than 60 per cent of participants said geopolitical risk, including the United States-China trade war or military conflict, was their main concern, even more so than short-term market volatility or regulatory change.

Climate change was named by less than 10 per cent of respondents as the most important risk facing the organisation.

For a general guide on ESG issues in Australia, please see here.

__________

[i3] Insights is the official educational bulletin of the Investment Innovation Institute [i3]. It covers major trends and innovations in institutional investing, providing independent and thought-provoking content about pension funds, insurance companies and sovereign wealth funds across the globe.

![Wouter Klijn, Director of Content at the Investment Innovation Institute [i3]](https://i3-invest.com/wp-content/uploads/2018/07/Wouter-Klijn-680-679x430.jpg)