The level of diversity of a company’s board of directors is directly related to the level of profitability and the ability to protect this profitability into the future, new research by Rosenberg Equities, a division of French asset manager AXA Investment Managers, has found.

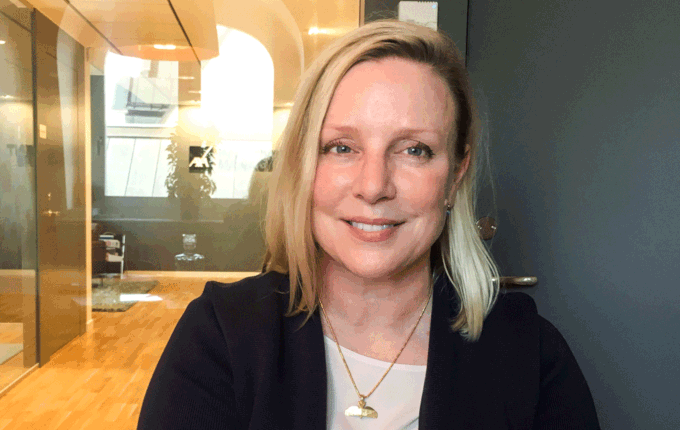

“When we take the most profitable stocks, and within that group look at the difference between the companies that are more versus less diverse, what we find is that the greater diversity you have, the more resilient that you appear to be in the face of competitive pressures, [and] the less reduction in forward profitability,” Kathryn Mohan McDonald, Head of Sustainable Investing at Rosenberg Equities, told a media briefing in Sydney recently.

McDonald looked at the profitability of the 1000 largest United States companies, as measured by return on equity (ROE), excluding extraordinary items, over the period January 2005 and July 2017.

She then looked at the top quartile of these companies and found that among this group, those companies with less than 20 per cent board diversity reported significantly worse average 12-month forward ROEs, a measure of future profitability, than companies with a board diversity of more than 20 per cent.

“When we then look at the time series of this period, we can see that this is true for every part of the economic cycle that we observed,” she said.

This ability to build a ‘moat’ around profitability was unrelated to size, she said.

“We were especially worried whether we were just capturing large mega-caps, since we are already looking in the top 1000, so there are no micro-caps. [But] it does hold true for smaller companies,” she said.

McDonald controlled the results for the market capitalisation of the stocks included.

“The first thing we can do is work with a basket of stocks that are weighted by the square root of their market cap, so you don’t get the market cap to dominate what we see. We can do a special analysis where you regress out size and we find that there is still a significant contribution from diversity, even after we neutralised size,” she said.

So why does diversity form a signal for profitability and the ability to protect profitability into the future?

To answer this question, McDonald went back to Michael Porter, a Professor at Harvard Business School, and his Five Forces Model of Competitiveness.

Applying Porter’s model showed companies with higher board diversity scored better on three of the five forces.

“What we believe is that diversity really helps head off the threat of new entrants, the threat of substitution and industry rivalry, which is commonly interpreted as innovation and evolution at the part of the company,” McDonald said.

“So we believe that the more diverse leadership a company has, the more likely it will end up with product lines that speak more directly to what customers want, engender loyalty of the customer base and have an ability to anticipate new markets for existing products.

“And there is a reasonable body of literature that talks about innovation, especially within the tech sector, as being better at more diverse firms.”

We find that there are positive economic outcomes for more diverse firms that can be attributed to diversity itself

In short, more gender-diverse boards are better at problem-solving than more homogeneous groups and this has a direct impact on a company’s ability to stay both relevant and profitable.

“We find that there are positive economic outcomes for more diverse firms that can be attributed to diversity itself,” McDonald said.

The signal is so strong that Rosenberg Equities has decided to build it into its own investment strategy as a source of alternative data on company fundamentals.

Gideon Smith, Europe Chief Investment Officer at Rosenberg Equities, expected this signal to be incorporated by the end of the year.

“I want to bring the ESG (environmental, social and governance) research into the fundamental models that we are using to construct portfolios,” Smith said.

“Right now the team is working on integrating this [signal]; we are running the final tests now.”

__________

[i3] Insights is the official educational bulletin of the Investment Innovation Institute [i3]. It covers major trends and innovations in institutional investing, providing independent and thought-provoking content about pension funds, insurance companies and sovereign wealth funds across the globe.