Insurance companies globally are diversifying their investment portfolios into more risky asset classes in response to the continuing low yields in the fixed income markets.

According to the latest GSAM Insurance Asset Management survey, insurers are decidedly more optimistic than in preceding years’ surveys. They showed a modest inclination to increase overall portfolio risk, expressing views to increase equity and credit risk.

Insurers are confident of the expected returns from growth-related asset classes, including private equity, US equities and emerging market equities.

They also anticipate increasing their asset allocations to higher-yielding and less liquid asset classes, such as middle-market corporate loans, infrastructure debt and collateralised loan obligations.

“The number one concern of insurance companies globally in every year that we’ve done this survey has been: ‘How do you increase the yield in your portfolios?’ In the first few years there was a loss of a willingness to embrace risk-taking,” Robert Goodman, Managing Director and Global Head of Insurance Relationships at Goldman Sachs Asset Management, says in an interview with [i3] Insights.

...when you start looking in other parts of Asia-Pacific and in Europe there is an enormous scarcity of attractive infrastructure debt and there is what you refer to as ‘crowding’ in accessing it.

“In recent years, there is a much greater willingness to take risks to produce that extra yield. As the industry generally has become capital rich, particularly on the P&C (property and casualty) side, they have been more willing to invest in illiquid assets, which in many cases are among the highest-yielding assets.”

Goodman doesn’t think the move towards more diversified portfolios will reverse once bond yields reach historical averages again.

“We see greater diversification in insurance portfolios in this low-yield environment as they enter new asset classes in search for yield. When rates rise again, we expect that insurers will remain more diversified. How are you going to keep them down on the farm after they’ve seen Paris?” he says.

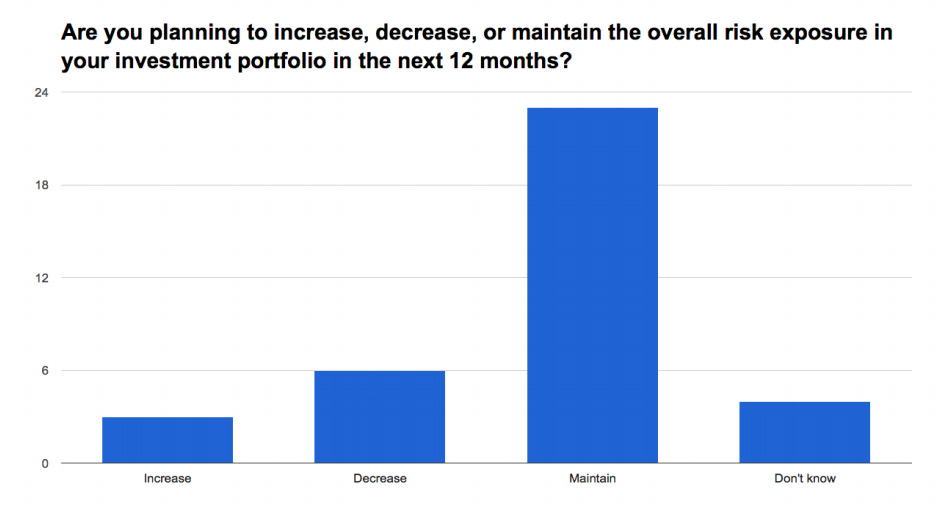

Audience polling at the Investment Innovation Institute’s [i3] Insurance Investment Forum held in Double Bay, Sydney, last month showed Australian insurers have a different view from their global peers.

A vast majority of insurers indicated they would maintain the level of overall risk in their portfolio, rather than increase it (see table 1 below).

Table1, source: Investment Innovation Institute [i3]

The GSAM survey was conducted in April 2017 and recorded the perspectives of 317 Chief Investment Officers (CIO) and Chief Financial Officers (CFO), representing over $10 trillion in global balance sheet assets.

The interest of insurers in unlisted assets, in line with the focus of other institutional investors, does cause concern for crowding into certain assets, Goodman says.

“One of the reasons why it is so difficult to extract attractively yielding infrastructure debt globally is because of the excessive level of demand over supply,” he says.

“Historically, this was less the case in Australia, simply because there has been a lot of supply in the infrastructure debt space. Some of the insurance companies we know have had no difficulty in accessing good Australia infrastructure debt.

“But when you start looking in other parts of Asia-Pacific and in Europe there is an enormous scarcity of attractive infrastructure debt and there is what you refer to as ‘crowding’ in accessing it.

“The US, unlike Europe and Australia, does not have a very long history of privatisation of infrastructure assets, which can result in infrastructure debt and equity opportunities. The only significant infrastructure debt market that we have here is municipal bonds, both tax-free and taxable. That tends to be invested in by insurance companies.”

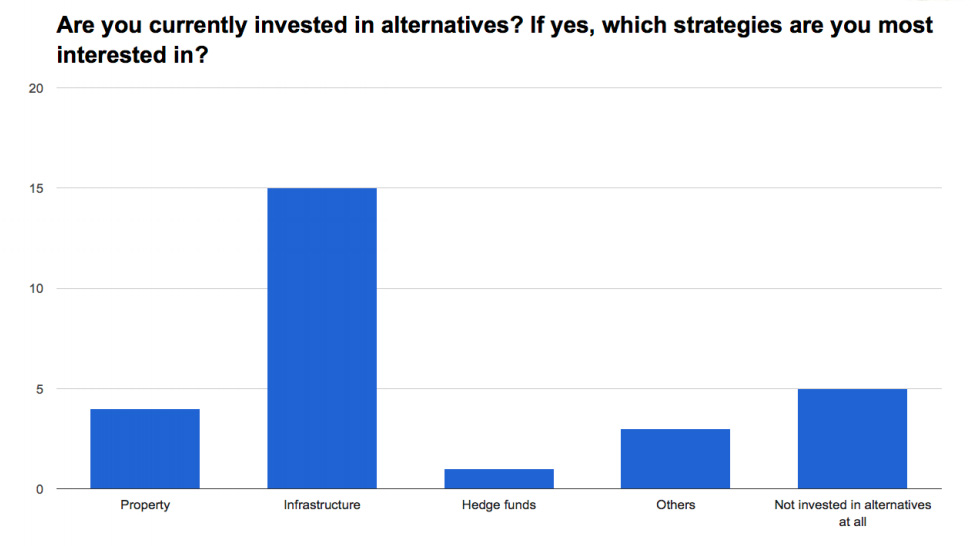

The audience poll at the [i3] Insurance Investment Forum showed Australian insurers are still mainly interested in infrastructure when it comes to investing in alternatives (see table 2 below).

Table 2, source: Investment Innovation Institute [i3]

The GSAM survey also revealed a dramatic reversal in insurers’ views on the credit cycle, expressing a view that the credit cycle has lengthened. Only one-third of insurers now believe we are in the late stage of the credit cycle compared to three-quarters of respondents last year.

Moreover, only 2 per cent of the respondents feel credit spreads will widen significantly this year. The reversal of the view on the credit cycle has resulted in an increase in corporate credit allocations, with one-third of insurers planning to lift their exposure to credit risk, GSAM said in the report.

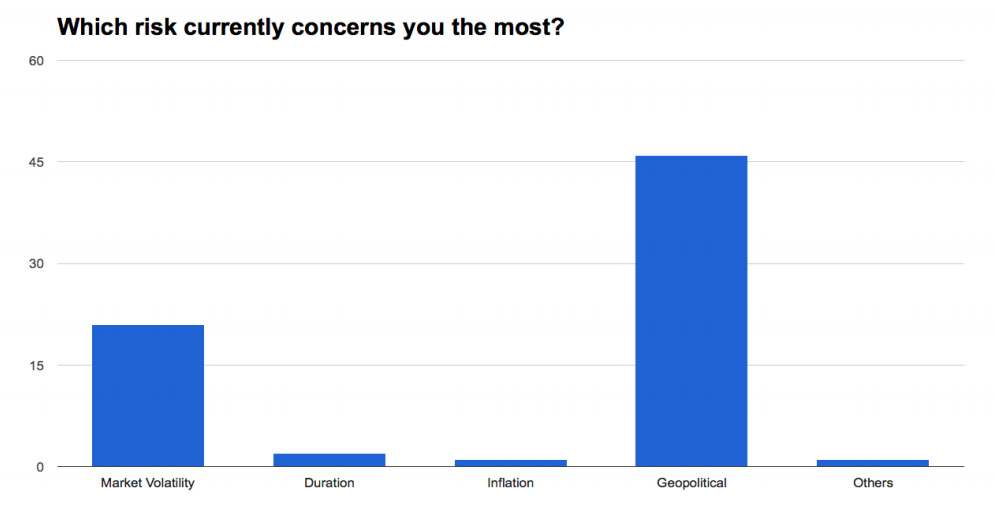

Table 3, source: Investment Innovation Institute [i3]

Political event risk jumped to the top of macroeconomic concerns in 2017, whereas previously it

was at the bottom of the list. This was in line with the results of the [i3] audience polling (see table 3 above).

Goodman says this is not so much to do with the increased focus of regulators on this area, but everything with the political turmoil seen around the world.

“I think it is less a regulatory or risk management issue and more a reaction to the amount of uncertainty. The degree of uncertainty that you see in many parts of the world, even where elections have taken place, the UK and the US, is much higher than people are accustomed to dealing with,” he says.

“As you know, markets don’t like uncertainty and what a lot of people tend to do when there is a lot of uncertainty is to become very defensive in their investing.”

__________

[i3] Insights is the official educational bulletin of the Investment Innovation Institute [i3]. It covers major trends and innovations in institutional investing, providing independent and thought-provoking content about pension funds, insurance companies and sovereign wealth funds across the globe.