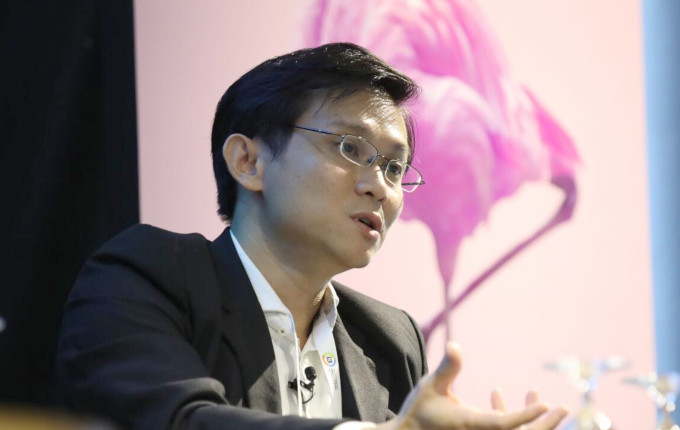

Electrical engineering might have little in common with investing, but the CIO of Singapore’s SAVER-Premium Fund finds there are synergies in being versed in both.

Register to Access this Exclusive [i3] Insights Article

Create a free account to access exclusive interviews with asset owners, revealing insights on investment strategies, market trends, and portfolio allocations.

If you already have an account you can Login .

If you have any issues registering an account please send us an email at [email protected].