With bond yields at record lows, traditional fixed income defensiveness is reduced and expectations of negative rates of return from bonds at current pricing, has increased the attractiveness of defensive options-based solutions and broader portfolio overlays as a form of protection, Michael Armitage writes.

As the superannuation industry struggles to manage portfolio risk in a zero-interest rate environment, additional tools and creative solutions will be necessary for these unprecedented times.

The first quarter of 2020 highlighted the magnitude and speed with which markets can fall.

More critically, for superannuation funds, the over-reliance on diversification alone for portfolio risk management was exposed as sub-optimal.

The acknowledgement that traditional fixed income defensiveness is reduced and expectations of negative rates of return from bonds at current pricing, has increased the attractiveness of defensive options-based solutions and broader portfolio overlay services.

Several of the best performing superannuation funds over this recent volatile period had utilised explicit protection strategies, granting them a more balanced approach than funds that relied solely upon diversification for risk management.

Pairing a diversified portfolio of growth assets with explicit protection proved to be a more robust approach. For many portfolio managers, explicit protection grants the ability to responsibly hold higher levels of exposure to growth.

Ironically, whilst many funds argue protection strategies have an upfront cost and negative expected return they don’t often think outside the square and realise that generating CPI plus five per cent can be made easier, with less tail risk, by allocating a small risk budget to overlay and increasing their equity allocation .

Going Japanese – Diminishing Protection from the Conventional Approach

Traditionally, investment portfolios relied upon diversification and risk-free government bonds to provide the necessary ballast for balancing portfolio risk.

As bond yields have reduced to near zero, concerns on the lower bound for interest rates and diminishing capacity of bonds to provide protection is a pressing concern. As mentioned, they may even increase risk in the portfolio given the current low level of rates and any rate normalisation.

Japan is a useful case study of the impact of zero-rate policy on a 60/40 ‘balanced portfolio’.

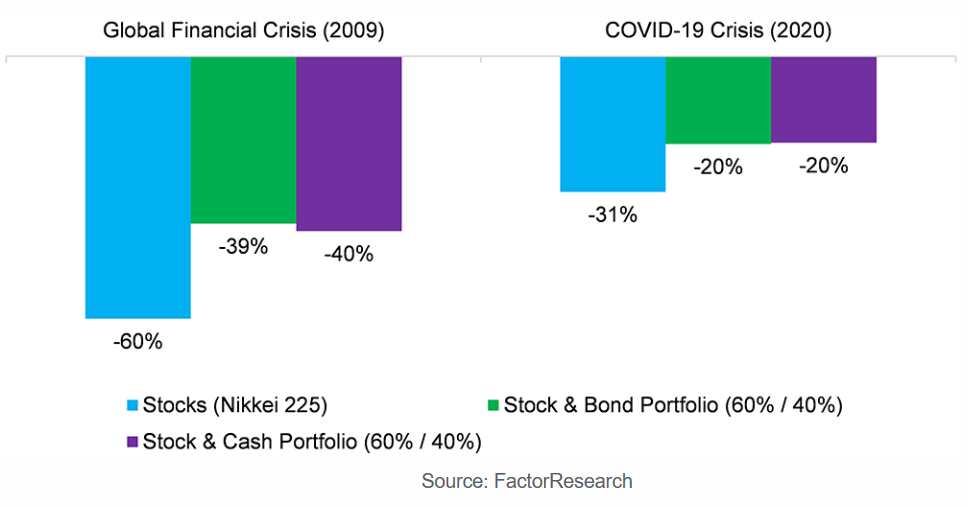

A recent analysis by FactorResearch, highlights bond market performance in the two most recent severe market corrections of 2008/9 and 2020, an environment where Japanese government bonds had already been yielding close to or below zero.

In Japan, a traditional equity-bond portfolio had lower drawdowns than an all-equities portfolio during the GFC in 2009 and the COVID-19 crisis in 2020. But it was still no improvement in simply holding cash rather than bonds, highlighting a limited ability for bonds to provide more convex payoffs given their lower bound.

Alternatives – Highlight Stock Like Properties

Many asset owners have over recent years sought to address the negative expected ‘real’ return from bond allocations by increasing allocations to infrastructure and other illiquid asset classes.

These assets are viewed as a mixture of defensive and growth features. However, the COVID 19 experience has underscored the variability in defensive characteristics these assets hold. Most illiquid assets did not provide much relief from the market sell-off and in some highly visible cases compounded issues for boards facing liquidity issues.

Many liquid alternative strategies including crisis ‘alpha’ strategies failed to provide the expected defensive punch in this latest crisis.

While liquid alternatives and private assets certainly contribute to overall longer-term diversification within portfolios, the variability of correlation cannot be relied upon for all negative market environments.

Further, given the conventional SAA framework within the Australian superannuation industry that holds high levels of growth risk exposure; the relatively small levels of allocations to defensive alternatives (less than 10 per cent) usually will not make a significant impact in a severe crisis.

In comparison, most explicit protection strategies utilise a relatively small budget with more significant and robust protection features.

There are two common ways of using options for this purpose.

Shoulder management

In this example funds target falls of 5-20 per cent in their protection strategies. That is, the overlay should prove a perfectly negative correlation to markets falling through this range. The reason a -20 per cent lower bound is expressed is twofold.

- The fund will generally be a buyer of risk assets after they have fallen 20 per cent and,

- Having this lower bound decreases the cost of an overlay such that one can spend less, or choose to have more impactful defence for these moves for the same spend.

This kind of shoulder management will generate a positive return more often than a more traditional protection strategy called ‘tail – risk’, as even a small drawdown can cover the annual protection budget.

Tail-risk

In a tail risk portfolio, generally the target range is for falls greater than 20 per cent. Protection is sought for less common events. What this means in principle is that because the protection is further out of the money, it will pay off less often but will also be less expensive.

Often tail risk portfolios are built with little quantitative framework which is why the experience can be disappointing. The utilisation of a fiduciary relationship with overlay specialist is recommended.

For example, there may not seem to be much difference between an 80% strike put option and a 75% strike put option – but this is not necessarily the case. Consideration must include multiple factors including strike, tenor, and volatility regime the market is currently in.

In both cases above a fund should balance their allocation to protection decision based on what they are prepared to invest each year, and what they are attempting to achieve in a falling market.

Ostensibly, buying an option to protect a portfolio is simple enough. What is difficult is making the most of your allocated budget by understanding the current efficacy of a position. More often than not a custom portfolio of option positions built specifically for a funds individual objective is the best way to make an overlay programme work.

Monetising

The ability to construct prior to overlay implementation, the parameters and operating protocol for a strategy, is an important operational value proposition for funds. As markets are often fast moving in stressed environments, having a protocol in place enables the fiduciary to operate on a short time frame without inefficiently waiting for Investment Committee manual decisions and artificial timelines.

The February/March sell-off and subsequent April/May retracement are a classic example of the necessity of speed in fast moving markets.

In March, Funds utilising option-based overlay services were able to:

- Defend against the worst of the market loss without relying upon diversification

- Provide cash liquidity, which was highly attractive for funds holding substantial illiquid assets

- Enabled timely re-balance at lower equity price levels for the subsequent market retracement.

Those able to move fast enough during that period should have made multiple times their initial investment. Dan Bosscher from Perennial Solutions Group, an overlay manager to a number of Australian superannuation and equity products confirmed “client experience from option strategy investmens was rewarding and provided an excellent source of liquidity for our partners in the first quarter of 2020”.

Summary

Derivative usage within funds is not new. Historically, funds have historically used derivatives for hedging currency exposure, manager transition portfolio management and through gaining straight forward passive exposures.

More recently, driven by the recognition that traditional approaches for portfolio risk management are challenged in this environment, funds are adding both more internal specialists and seeking partnerships with overlay managers.

As funds increase their research and utilisation of overlay and execution services, evaluation of qualified partners will be critical to any program.

Fiduciary relationships with experienced overlay managers knowledgeable of superannuation governance and stakeholder needs may be more ideal partners.

In contrast with a bank relationship, which is often transactional in nature, the fiduciary relationship is more in line with maximising the client’s performance.

Additionally, prior success navigating the needs of various stakeholders and boards within the research and approval process are welcomed skills to provide efficient time management and a likely smoother process. Experience cannot be replaced.

Michael Armitage is Principal of Fundslab, which provides strategic consulting and research services for asset management companies, asset owners and wealth management teams. Armitage has over 30 years of experience across capital markets, absolute return strategy research and development, and overlay risk management consulting and has held senior roles with Mercer, Milliman and S&P Global Market Intelligence.

This material is intended to provide background information only and does not purport to make any recommendation upon which you may reasonably rely without further and more specific advice. Past performance is not a reliable indicator of future performance, and no representation or warranty, express or implied, is made regarding future performance.

__________

[i3] Insights is the official educational bulletin of the Investment Innovation Institute [i3]. It covers major trends and innovations in institutional investing, providing independent and thought-provoking content about pension funds, insurance companies and sovereign wealth funds across the globe.