Most of us are familiar with the Black Swan theory (the book with the same title was published in 2007), developed by Nassim Taleb, describing rare and uncertain events, but bearing high consequences. The current COVID-19 pandemic can arguably be defined as a Black Swan event.

Published five years later as part of Nassim’s five-part Incerto, Antifragile is defined as the antidote to the Black Swan. It goes beyond being robust or resilient. It is about thriving in situations of volatility, uncertainty and market stress.

Taleb used ancient mythology to differentiate fragile, robust and antifragile:

- Damocles, who dines with a sword dangling over his head, is fragile. A small stress to the string holding the sword will kill him.

- The Phoenix, which dies and is reborn from its ashes, is robust. It always returns to the same state when suffering a massive stressor.

- But the Hydra demonstrates antifragility. When one head is cut off, two grow back.

Is Real Estate Investing Antifragile?

In a recent research paper, Norman Miller, Ernest Hahn Chair and Professor of Real Estate Finance at the University of San Diego, and Guy Tcheau, Managing Director at Principal Real Estate Investors, attempted to examine if real estate investments exhibit robust and antifragile characteristics in response to Black Swan events.

(1) Robustness

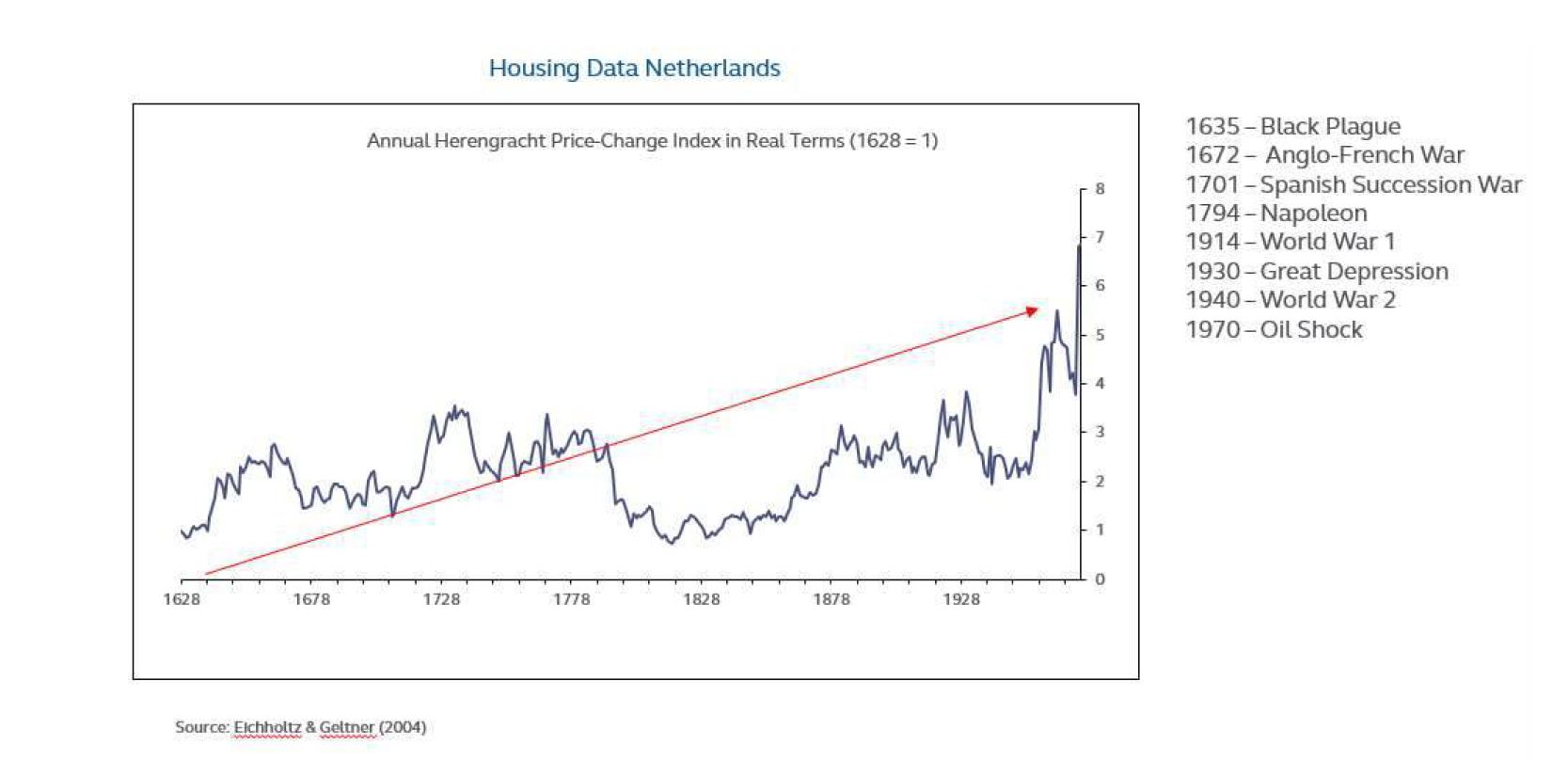

Using empirical data over the last 400 years, spanning major Black Swan events such as the Black Plague, Napoleanic Wars, World War I and II, the Great Depression and the Spanish Flu, Miller and Tcheau observed that real estate price changes (in real terms) supported asymmetry towards the upside, with a finite downside.

As compared to the performance of public equities or bonds during Black Swan events, where the value of the underlying securities may trend towards zero, real estate investments are underpinned with tangible real assets, providing an asymptotic base on the downside.

(2) Antifragility

What exactly are antifragile investments?

These are investments that benefit from volatility. Mathematically, this is referred to as convexity. The higher the volatility in the events under Taleb’s model, the greater the payoff with convexity.

The key question here is whether real estate investments exhibited convexity.

In addressing this question, Miller and Tcheau dissected real estate investing through the lenses of:

- Long versus short term

- Supply versus demand

- Exogeneous versus endogenous

- Aggregate versus segment

The authors admitted that Black Swan events hurt real estate values in the short term. However, the losses reach a floor due to the intrinsic underlying asset values. It subsequently recovers and rebounds, moving to the upside in the longer term due to the curtailment of new supply. While real estate, like other businesses, respond to the economic law of demand and supply, real estate cycles are impacted more by supply than demand shifts.

Following a Black Swan event, the supply of capital for construction of new projects is often curtailed, stemming from fear, policy measures and risk-off mentality. However, real estate demand, which ultimately is a derivative of population and employment, increases in aggregate over the long term even as supply changes are in hiatus. The combined effect of supply curtailment and demand growth leads to equilibrium pricing moving upwards.

However, the authors point out that these observations are aggregate and individual property segments are impacted by demand forces idiosyncratically. For example, retail has been negatively impacted by e-commerce, while logistics and industrial have conversely benefited.

Severity of Crisis

Following the Global Financial Crisis about ten years ago, there was a dramatic reduction of new supply across real estate, as expected. However, the authors observed that the severity of the shock, i.e. volatility, correlated to the corresponding reduction in new construction. Given the predominantly endogenously driven nature of this asset class, this is precisely the impetus required to produce upwards pricing towards long term equilibria.

In the aftermath of the 1991 Savings and Loan crisis, US commercial real estate produced 19 quarters of above 10 per cent returns. The Global Financial Crisis, which was a more severe recession, was followed by 23 quarters of above 10 per cent return from real estate.

By tracing commercial real estate performance since 1979 against GDP perturbations, the authors concluded that the performance of real estate in the longer term exhibited convexity with respect to the severity of a Black Swan event. Convexity is the mathematical definition of antifragility, according to Taleb.

The current COVID-19 pandemic has already seen central banks lowering rates to historical lows. While this will cause yield from fixed income assets to fall, it bodes well for real estate investments due to the impact on asset price reflation, adding to this antifragility thesis.

While the research focused on private equity real estate only, the authors expect the antifragility benefits to accrue to all four quadrants of real estate (public and private, debt and equity) in varying degrees.

Based on the research, the authors suggest that performance of multi-asset portfolios will benefit in the longer run from higher allocations to real estate.

For the full research paper, click here: Antifragility of Real Estate Investments in a World of Fat-Tailed Risk

__________

[i3] Insights is the official educational bulletin of the Investment Innovation Institute [i3]. It covers major trends and innovations in institutional investing, providing independent and thought-provoking content about pension funds, insurance companies and sovereign wealth funds across the globe.