Simple is not always better, as even simple investment strategies can have unexpected consequences. But when embracing complexity, make sure you get all stakeholders on board.

When discussing the merits of complexity, people often like to quote Albert Einstein.

“Everything should be made as simple as possible, but no simpler.”

The beautiful irony in this case is that what Einstein really said was far more elaborate, but also more accurate. During a lecture in 1933, he argued:

“It can scarcely be denied that the supreme goal of all theory is to make the irreducible basic elements as simple and as few as possible without having to surrender the adequate representation of a single datum of experience.”

But it took United States composer Roger Sessions to distill the essence of this line into the famous quote we all know and that is now embedded in the public consciousness.

It shows simplicity and complexity both have their roles to play, but can have distinctly different functions.

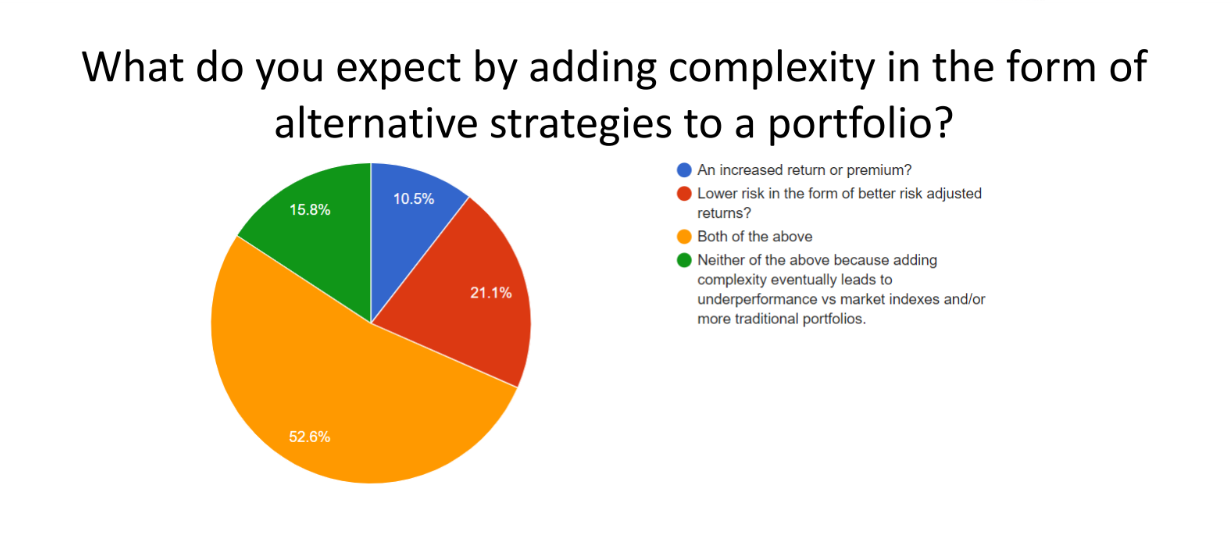

At the [i3] Asset Allocation Forum in Bowral last month, participants discussed the use of complexity in investment portfolios and how to best set a governance framework around it to avoid unintended outcomes.

During a polling session, participants agreed complexity has a role to play as it can increase returns and lower risk.

Source: Investment Innovation Institute [i3]

But introducing complexity is not without risk. Sure, investment risk is one of them, but the ability to explain complex strategies to stakeholders to a level they are comfortable with is an entirely different kettle of fish.

Career risk is a real danger in implementing sophisticated investment strategies and requires careful management.

So how do you bring the various stakeholders along with you? Participants had different views on this.

Some argued that if the chief investment officer of a pension plan knew significantly more about the workings of a fund’s investment strategy than the board, then that would be a serious governance issue.

Such an asymmetry of information would be in need of rectification.

But others argued the idea of equal levels of comprehension for investment staff and board directors was unrealistic.

One participant argued complex investment strategies are more akin to brain surgery than to something like car mechanics.

Despite the increased complexity of vehicles over the years, it is possible to learn all there is about the workings of an engine, but there are still many brain functions we simply don’t understand.

Yet, we trust our brain surgeons.

Similarly, there needs to be a level of trust between the CIO, board of directors and investment committee (IC).

The relationship between the IC chair and the CIO is especially critical, participants felt, and to ensure mutual trust is maintained between all of them, the relationship needs to be managed.

Several participants argued that when hiccups happen, the IC chair needs to be informed ahead of time, not just when the next scheduled meeting takes place.

The same counts for big changes to the investment strategy. Make sure your stakeholders have heard you speak about a strategy many times before you suggest adopting it, they said.

Education is a big part of a CIO’s role.

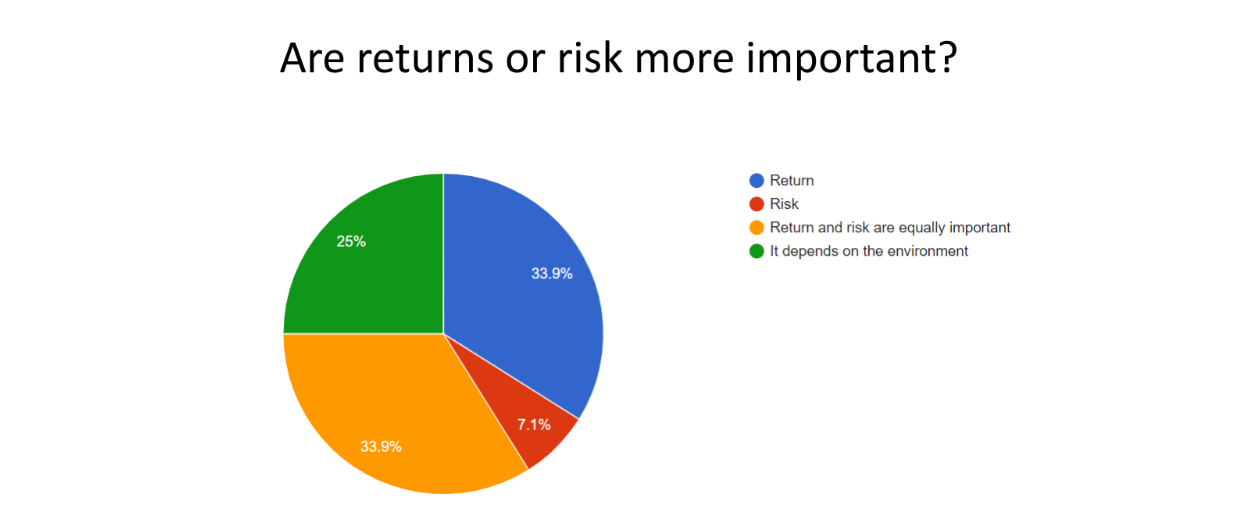

Source: Investment Innovation Institute [i3]

It is true simple strategies are often more easy to communicate and may have a higher rate of success in getting across the line.

But they are certainly not always better.

One participant pointed out that even simple strategies are going to suffer from unexpected behaviours. For example, in the current market environment, bonds are not behaving as they are supposed to and neither are equities.

Many participants felt the current set of market circumstances requires more complex strategies if one is to avoid tail events in the portfolio.

But to get there one needs to inform, educate and hold hands. And when a board or IC composition changes, chances are you will have to go back to square one.

For a general guide on ESG issues in Australia, please see here.

__________

[i3] Insights is the official educational bulletin of the Investment Innovation Institute [i3]. It covers major trends and innovations in institutional investing, providing independent and thought-provoking content about pension funds, insurance companies and sovereign wealth funds across the globe.

![Wouter Klijn, Director of Content at the Investment Innovation Institute [i3]](https://i3-invest.com/wp-content/uploads/2018/07/Wouter-Klijn-680-679x430.jpg)