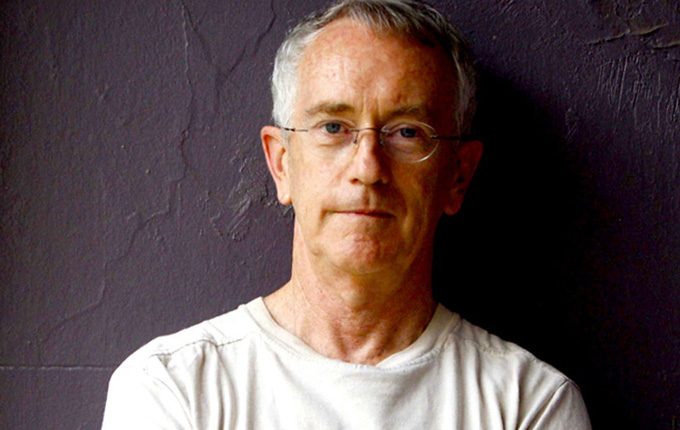

Professor of Economics Steve Keen has been credited as one of the few economists who saw the global financial crisis of 2008 coming and now he warns about a new one.

At the beginning of this month, Keen published a new book with the title: ‘Can We Avoid Another Financial Crisis?’

In this book, Keen shows how rising levels of private debt make another financial crisis almost inevitable unless governments tackle the underlying causes of financial instability.

He identifies five vulnerable economies, which he has dubbed ‘The Walking Dead of Debt’, including Australia, Belgium, China, Canada and South Korea.

The problem, Keen says, is partly due to the largely ignored interplay between credit growth and financial stability.

“You can’t predict financial crises working from a set of premises which are false and [neo-classical economists’] false premises are that banks are just intermediaries,” he says in an interview with [i3] Insights.

“They claim that banks don’t actually originate loans, don’t originate money either, but what they do is that they act as a sort of Ashley Madison for the finance sector. They don’t lend you money, but they will introduce you to someone who will lend you money and charge you a fee for the introduction.

“Banks are not the Ashley Madisons; they are the red light district of money. They supply the product in exchange for a payment.’ What you then find is that the whole logic economists make about trying to ignore credit disappears,” he says.

The amount of money a bank is willing to lend out depends on how much leverage a bank is willing to take on. What happens in asset bubbles is that lenders become less prudent and leverage ratios start to drift out.

The crunch comes when the rate of debt slows down and it doesn’t have to slow down a lot for a crash to happen. The solution, according to Keen, is quantitative easing (QE) for the masses.

At some point, people stop borrowing money and when this happens credit disappears and total demand in the economy plummets, Keen says.

“The total demand in an economy is the sum of the turnover of the total amount of debt plus credit,” he says.

“If you are getting to a stage where debt is growing by 20 per cent of GDP (gross domestic product) per year and credit is therefore 20 per cent of GDP then that is an enormous boost to demand and the economy looks like it is booming.

“In that case, governments can ramp up large surpluses because there is so much money being created and it looks like they are doing a great job. But the private sector’s books are going to cactus because of the increasing level of leverage.

“You get yourself in a situation where there is a boom created by the whole process that undercuts the profitability of some of the borrowing.

“People stop the borrowing and when they stop borrowing credit evaporates and goes from 20 per cent positive to minus 5 per cent. You get to a 25 per cent decrease in aggregate demand.

“That is what happened in 2008 to America: they went from plus 15 per cent to minus 5 per cent between 2008 and 2010. That is why it was so severe,” he says.

But this link between credit and demand is largely ignored, Keen says.

“When you look at the data, it is bloody obvious. It requires special training not to see it and that special training is called a Phd in economics,” he says.

In Australia, credit growth has been strong and when this growth slows down, the economy faces a crisis.

“The crunch comes when the rate of debt slows down and it doesn’t have to slow down a lot for a crash to happen,” he says.

The solution, according to Keen, is quantitative easing (QE) for the masses.

The government would instruct banks to pay down the account holders’ debt through cash and if a person had no debt, then they would simply receive the cash.

This is a much more efficient way of boosting the economy than the current form of QE which largely leads to inflation of asset prices, he says.

Keen will retire next year from teaching at London’s Kingston University and is seeking to raise money to continue his research into the role of credit and other areas.

In order to do so, he has chosen a form of crowdsourcing through a platform called Patreon, which allows people to fund his research in the form of a monthly donation.

When pledging US$10 to his course, supporters get access to podcasts of interviews with Keen by radio journalist Phil Dobbie.

For more information, please see: https://www.patreon.com/ProfSteveKeen

Can We Avoid another Financial Crisis?

By Steve Keen

140pp. Polity Press 2017

Steve Keen spoke at the [i3] FICC Luncheon on 24 July 2017 in Melbourne.

__________

[i3] Insights is the official educational bulletin of the Investment Innovation Institute [i3]. It covers major trends and innovations in institutional investing, providing independent and thought-provoking content about pension funds, insurance companies and sovereign wealth funds across the globe.