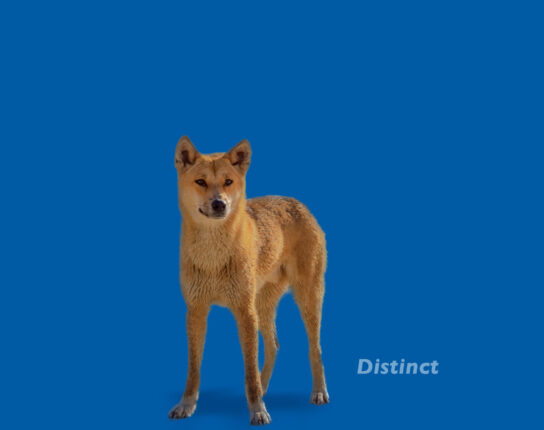

Wolves or Wild Dogs?

Dingoes are possibly one of the most misunderstood animals in Australia.

A high debated issue in Australia relates to whether dingoes should be classified as dogs versus wolves, given the similarities they share with both types of animals. Depending on the criteria used – domestic status, social behaviour, communication, anatomy etc – it may be considered a form of domestic dog, a subspecies of dog or wolf, or its own unique species.

Hybridisation: Blurring Traditional Boundaries

More interestingly, the biggest threat to dingoes are dogs, but not in a predatory sense. Interbreeding between dogs and dingoes decreases the population of pure dingoes, resulting in the vulnerability of the species.

Conversely, the property asset class may need to embrace a flexible hybrid approach to minimise its vulnerability to secular changes

- Is the nature of property growth or defensive, as part of portfolio construction?

- Is there a role for REITs in the property portfolio? Or do they only belong to in equity portfolios?

- With the current business cycle, should there be a more complementary role for real estate debt?

- Is residential real estate eg BTR becoming a more investable asset class? Is there scope for affordable housing?

- Traditional sectors versus alternatives: How do you deploy high conviction ideas?

- Energy transition risks and the rocky road to net zero

Regime change

While the impending end of the pandemic should usher in more optimism eg relative attractive valuations of retail assets or more certainty in office assets, investors now have to grapple with a secular regime change impacting the investment environment.

Tightening monetary policies, increasing geopolitical tensions, deglobalisation, inflation and climate change are some of the structural forces expected to impact the investment environment in the long term.

In addition, superannuation funds need to remain cognizant of the unintended consequences imposed by the APRA performance test.

Building Resilience in Property Portfolios

In the annual forum for asset owners focusing on real estate investing, we will discuss how investors can build robust portfolios, with consideration to:

- Local vs offshore exposures: US vs UK vs Continental Europe

- Beyond Core: Core+ and alternatives; Sectors vs themes

- Access Channels: REITs vs unlisted; Direct vs co-investments vs funds

- Capital structure: Real estate debt vs equity

- ESG integration and sustainable investment opportunities