Institutional investors are divided on the best way to invest in AI, but agree it will have a profound impact on investment strategies in the coming years.

Institutional investors remain divided on the best way to gain exposure to artificial intelligence (AI) as they have doubts about the ability of companies to monetise this innovative technology, while the adoption of it is likely to broaden out beyond the Magnificent Seven alone.

Yet, they also agree AI is one of the most important developments today and will have a significant impact on investors’ strategies going forward.

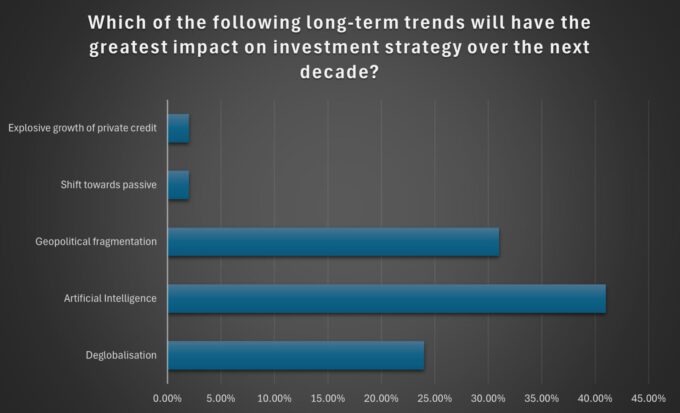

During a poll at the [i3] Asset Allocation Forum, held in Terrigal last week, a majority of delegates identified AI as having the greatest impact on investment strategies over the next 10 years, ahead of deglobalisation and geopolitical fragmentation.

Source: Investment Innovation Institute [i3]

“Any company that wants to survive in 10 years’ time needs to invest in AI. But on the revenue side, there is still a question around the ability to monetise it,” one delegate said.

This sentiment was reflected in a recent note by Dan Farmer, Chief Investment Officer of MLC Asset Management. While revenues derived from AI have been modest, Farmer pointed out productivity gains also have been subdued.

“Businesses adopting AI have so far reported underwhelming productivity or profitability improvements,” he said.

Instead, many current applications of AI deliver what he called “micro-productivity” improvements: automating emails, scheduling or document drafting. “While helpful, these enhancements rarely transform the economics of a business,” he said.

But he also pointed out that over the longer term, AI will result in significant changes for the global economy.

“The surge in research, investment and foundations being laid are very real and should eventually deliver meaningful benefits. The next one to two years are expected to be critical for AI to deliver tangible returns and begin to substantially lift mainstream business productivity,” he said.

Adoption Beyond the Magnificent Seven

The stellar rise of the Magnificent Seven in recent years has been explained by optimism over AI’s ability to boost growth, while data centres have also been a clear beneficiary from this trend.

Energy utilities are another way to play this development. In the United States, data centres alone are expected to drive nearly 50 per cent of electricity demand growth through to 2030.

One delegate argued utilities form a relatively safe way to play into the AI trend because it will require a lot of electricity, yet if the trend turns out to be a dud, then utilities will still be needed.

“A safe way to play into AI is to invest in energy utilities. We are long nuclear and that is a clear AI play,” one delegate said.

And it is not just the old economy, core infrastructure assets that are likely to benefit from this new technology, but also the next generation of assets, the so-called ‘infrastructure 2.0’, are expected to gain from this trend.

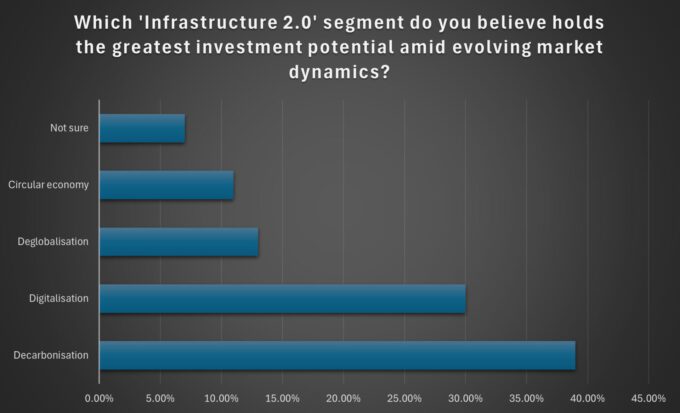

When delegates were asked what segment of infrastructure 2.0 had the greatest potential going forward, digitalisation was the second most nominated category. Only decarbonisation was deemed to have the potential to have a bigger impact.

Source: Investment Innovation Institute [i3]

Venture capital (VC) was also named as a key way to take exposure to AI. The percentage of VC deals involving AI has grown from 45 per cent last year to 60 per cent this year, a fund manager stated during the forum.

The Risk of Early Adoption and Investment

But being ahead of the pack can be risky. As AI finds broader applications across industries, many large businesses will likely incorporate it into their activities and so the AI trend might filter down to the majority of index companies.

If this is the case, then investors might be better off waiting to see this unfold, rather than frantically trying to identify companies on the bleeding edge of innovation.

“What is the best way to play into innovation? Sometimes the argument is made that the best way is to do nothing,” one delegate said.

However, this will only work if investors have broadly diversified portfolios. If they have more concentrated, high-conviction portfolios, they could miss out.

“But portfolios are not always set up that way. What have you got? Is it diversified enough? What are you exposed to?” one delegate said.

Asked if investors already incorporated AI in their own processes, they said they often found the answers of large language models of limited use. Where it does provide a benefit is in distilling large amounts of data into more manageable summaries.

“AI provides very superficial insights, but we use it to synthesise huge amounts of data,” one delegate said.

__________

[i3] Insights is the official educational bulletin of the Investment Innovation Institute [i3]. It covers major trends and innovations in institutional investing, providing independent and thought-provoking content about pension funds, insurance companies and sovereign wealth funds across the globe.