I’m a firm believer in the value of active investment management.

I also believe that 95 per cent of institutions should invest passively.

No, I’m not confused or delusional. My apparently contradictory viewpoint is the result of a deliberate effort to synthesise both sides of the active vs passive debate.

Most of the active versus passive debate focuses on the analysis supporting either the active or the passive side. In reality, the correct decision depends on the circumstances (see my earlier post).

This is why synthesising the arguments from both sides of the debate is vital. One of the best examples of the power of synthesis is the legendary Charlie Munger. Here’s a thought-provoking quote from Charlie courtesy of an interesting piece written by the Farnham Street Blog entitled The Work Required to Have an Opinion.

“The ability to destroy your ideas rapidly instead of slowly when the occasion is right is one of the most valuable things. You have to work hard on it. Ask yourself what are the arguments on the other side. It’s bad to have an opinion you’re proud of if you can’t state the arguments for the other side better than your opponents. This is a great mental discipline.”

I’m going to take up Charlie’s challenge: an active investor presenting the case for indexing better than a passive investor. There’s a lot to cover, so I’ll tackle the subject in three parts:

This month, I’ll look at the commonly offered reasons why active management so often underperforms, some of which are either weak or vary according to the circumstances.

In part II, I’ll discuss some of the more plausible reasons why active management usually delivers poor results.

Finally, in part III, I’ll name what I think are the strongest arguments in favour of indexing.

What has my attempt at synthesis taught me? That active management usually fails, not because the many reasons cited by most proponents of passive, but because of the behaviour of investors, poor incentives and the impact of costs.

Part I – Commonly Cited Reasons

Without further ado, here are my observations on part I – the most commonly-cited reasons why active management is a bad idea.

1. Markets are efficient. Prices reflect all public information (semi-strong efficiency).

All information includes both good and bad information. There’s often a lot of bad information in the price for a simple reason – nobody really knows what will happen in the future.

Prices often include information that has little or nothing to do with the fundamentals of the underlying company. Institutional investors are subject to variety of constraints which affect the price of certain investments. This is information may be in the price but it’s not information about the company, it’s really information about the investor. For example, the price of microcap stocks includes the fact that most institutional investors are too large to invest in them.

Time horizon matters. If the majority of market participants focused on the short-term, then the price will predominantly reflect short-term information. This potentially creates opportunities for investors with a longer investment horizon. See point 6.

2. Diversification is the only free lunch. A market-capitalisation-weighted index is well-diversified.

A lot of active decisions go into creating an index. Constructing even the most straightforward market-capitalisation- weighted index involves making decisions such as:

- Which markets to include

- Minimum free float

- Minimum daily volume (liquidity)

- Frequency of index reconstitution

- Target number of stocks or percentage of market capitalisation covered

These decisions can have a large impact on the resulting level of diversification.

Concentrated markets create undiversified indices. For example, the S&P ASX 200 has a 27.5% weighting to Australia’s four major banks. I would argue that investing over a quarter of your money in companies with a highly-leveraged exposure to Australia’s already leveraged property market is not diversification.

The most extreme examples of index concentration are Nortel (Canada), Ericsson (Sweden) and Nokia (Finland) which in the late 1990s were one third, one half and two thirds of their respective country indices.

An Index has factor exposures too. Investing in a market capitalisation-weighted index comes with several factor exposures, including:

- Size – larger stocks

- Value – more expensive stocks

- Momentum – stocks that have recently done well

Each of these factors experience cycles. There will be periods when these factor exposures help the index outperform active managers. And there will also be periods when these exposures hurt the performance of the index.

3. Between 60-90 per cent of active fund managers underperform the market each year.

This is exactly what we should expect. Active investing is a competitive activity where the costs to play (transaction costs, fees and taxes) are high.

Don’t confuse the activity of investing with the business of investing. Passive investors quoting the dismal performance of active management make this mistake all of the time. Most of the underperformance of active management can be explained by things that active managers do to increase the size of assets that they manage and to retain clients.

It’s not that active fund managers lack skill. In fact, the evidence points to the contrary. It’s just that they capture most of the benefits of that skill for themselves (see my earlier post).

4. There is little or no performance persistence from year to year.

Inconsistent performance refreshes the opportunity set for active management. Imagine if an active strategy worked consistently, year in, year out. Pretty soon every investor would be following that strategy. The price of the assets selected by the strategy would increase, reducing future returns (remind anyone of unlisted infrastructure?). Consequently, the strategy would underperform, investors progressively would abandon it over time, driving the price of assets selected by the strategy down and once again creating an opportunity.

Career horizon ≠ investment horizon. The active performance cycle can take 7-10 years to play out (even more for unlisted assets). This is an eternity in an industry where many people change jobs every 3-5 years and when most directors have term limits that are shorter. In other words, they probably won’t be around to reap the rewards when the cycle turns so all they’re left with is the risk.

Long-term outperformance requires prolonged periods of underperformance. In an earlier post,I cited the results of a Vanguard study examining the performance of 1540 actively managed US mutual funds that were available at the beginning of 1998. They found that only 275 or 18% of funds both survived and outperformed their benchmark.

But the most interesting result concerns the 275 fund that did beat the market. 97% of them underperformed for at least 5 years. In other words, virtually all of the funds that beat the market spent at least 33% of the time trailing the market!

Wes Gray illustrates the inevitability of underperformance even more clearly in one of my all-time favourite Alpha Architect posts: Even God would Get Fired as an Active Investor. It’s a must-read for anyone that invested in an active (fundamental or quantitative) investment strategy.

5. Active management is simply factor investing in disguise and at a higher cost.

Screening introduces factor exposures. A lot of fund managers use screens to reduce the number of stocks to a shortlist for further fundamental research. In other words, managers start with the market, create a factor portfolio and then overlay active management on top. No wonder the large and persistent factor exposures present in many active portfolios.

A couple of years ago, I started asking fund managers if they had ever compared the performance of their fund to the performance of their initial screen as a portfolio. I was shocked to find out that most hadn’t. What was even more shocking was the response that I received when I suggested that they should charge a base fee equivalent to an index fund and a performance fee for out-performance above a factor index that best matched their investment philosophy and process. Needless to say, I didn’t make many new friends!

There is a lot of validity to this criticism of active management. There are some fund managers out there that are truly adding value through genuine skill, but they are the minority.

Asset allocators need to take more responsibility. I don’t put all of the blame on fund managers. The behaviour of their clients and consultants often creates perverse incentives to hug the benchmark and therefore all but guarantee mediocre results after fees.

6. Regulation and technology have reduced many of the information asymmetries that made active management profitable.

The information edge available to active managers has deteriorated over time. For example, when Warren Buffett started investing in the 1950s, most companies did not report a statement of cash flows. The precursor to what we now know as the statement of cash flows only became mandatory in the US in 1973. Quite the contrast to today’s availability of data, where hedge funds even use satellites to count the number of cars in the parking lots of Walmart.

“Weak games” can be found, but they are capacity constrained. There are still corners of the market where competition is not as strong, usually because one or more constraints make it difficult for institutions to invest. Frontier markets and microcap stocks are two examples that come to mind. The inability to deploy large sums of capital to these opportunities keeps much of the competition away.

The behavioural edge is arguably stronger than ever. As an industry, asset management is more focused on the short-term than ever before and the chain of intermediaries between the customer and the investment is longer than ever before. Conflicts of interest and the tensions between principal and agent remain. Our brain chemistry and basic patterns of behaviour haven’t changed.

All of which create opportunities for those that are patient and relatively free to apply common sense. The true genius of Warren Buffett and Charlie Munger was to create a corporate culture which allowed them to take their time, think deeply and avoid the compulsion to act. Most importantly, they replaced office politics with genuine skin in the game.

The best investors are those that create a process to help them behave correctly. I’ve noticed that many of my peers waste a lot of time assessing the quality of a fund manager’s idea generation. For example, they’ll get the manager to take them through stock examples or explain their valuation model.

Why is this largely a waste of time? Because we all know that even the best fund manager struggles to get 55% of their stock picks to be correct. It’s what they do when they are right (i.e. position sizing) and more importantly what they do when they are wrong (sell discipline) that matter as much, if not more.

Behavioural decisions such as position sizing and sell discipline don’t get any easier just because we have more information. The challenge of managing our behaviour still remains. This is particularly true in a market that dominated by people managing other people’s money, often with very little skin in the game.

7. Get enough coin flipping orangutans tossing coins and at least one will come up with 10 heads in a row.

Statistics are of little help in selecting a fund manager. Why? The amount of time required to generate a track record of performance long enough to make statistical analysis possible is too long.

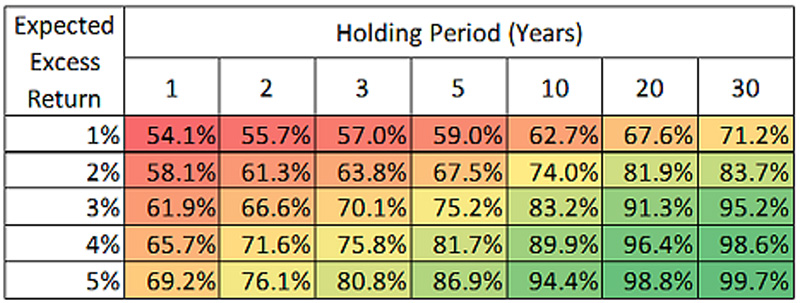

For example, here’s a table taken from Jeremy Siegel’s book Stocks for the Long Run. The data in the table is based on the performance of US mutual funds.

Let’s assume that a fund manager beats the market by 3% per year for 10 years. In that case, there’s an 83.2% probability that this performance was due to manager skill. That also means that there’s still a relatively high probability, almost one in five, that it was luck.

Here’s a quote from Siegel, a US Professor of Finance, on using statistics to help select fund managers.

Detecting a bad manager is an equally difficult task. In fact, a money manager would have to underperform the market by 4 percent a year for almost 15 years before you could be statistically certain (defined to mean less than 1 chance in 20 of being wrong) that the manager is actually poor and not just having bad luck. By that time, your assets would have fallen to half of what you would have had by indexing to the market.

How can we select a fund manager if statistics aren’t much help? You can find some suggestions in an earlier post.

8. Positive skew: The majority of the market’s return is due to a handful of stocks. You want to diversify and buy-and hold so that you capture these engines of growth. This point is related to the popular argument that stock-specific is unrewarded and should be reduced through diversification.

Indexing makes fewer decision and therefore fewer mistakes. One of the biggest advantages of indexing is that there are fewer investment decisions and therefore fewer opportunities to get things wrong. This is important because of the way in which stock returns are distributed.

Only a handful of stocks account for the majority of the market’s gains A long-term study (1983–2007) of the largest 3000 stocks listed in the United States found that:

- 39% of stocks had a negative lifetime total return (2 out of every 5 stocks are a money losing investment)

- 5% of stocks lost at least 75% of their value (Nearly 1 out of every 20 stocks is a really bad investment)

- 64% of stocks under-performed the Russell 3000 during their lifetime (Most stocks can’t keep up with a diversified index)

In other words, there’s a high probability that an active investor will select losing stocks (since there are so many of them) and miss out on the handful of winners (since they are fewer and tougher to identify in advance). Meanwhile the index investor captures ALL of the winners by default.

For those interested in finding out more, I suggest reading Bloomberg’s The Math Behind Futility and Alpha Architect’s Treasury Bills Outperform Most Stocks – Say What???.

The stock market is positively skewed and most investment behaviour creates negatively skewed returns. Not only is the market positively skewed (and therefore tough to beat) but behavioural biases such as the disposition effect often result in portfolio returns being negative skewed.

The disposition effect results in investors selling stocks that outperform only to hold stocks that underperform. In other words, it is highly unlikely that an active investor will hold a long-term winning stock even if they are skilled (or lucky) enough to find one.

The turnover of most active strategies is far too high. In his book 100 Baggers: Stocks That Return 100-to-1 and How To Find Them, Chris Mayer identified over 300 US companies between 1962-2014 whose market cap increased by 100-times or more. It took most companies somewhere between 16-30 years to achieve this feat, with the shortest time being 4.2 years (Franklin Resources. Nobody ever said asset management doesn’t pay.) So why do I see so many fund managers with annual turnover of 50%, 75%, 100% or even more?

9. Warren Buffett is just a freak. We shouldn’t try to copy him.

All depends on what you’re trying copy. As noted earlier, Buffett’s true genius is in creating the right culture for an investment organisation. Buffett’s investment strategy has changed over the years:

- Early – Graham and Dodd net-nets, deep value (“cigar butts”) and merger arbitrage.

- Middle – great companies (i.e. an enduring “moat “) at reasonable prices (the influence of Charlie Munger).

- Late – Private investments, special one-off deals and securities.

True, it may not be appropriate to copy Buffett’s investment strategy as our circumstances and abilities are undeniably different to those of Buffett. As institutional investors we may be managing too much money to effectively target capacity constrained opportunities such as special situations investing. But we can and should copy the fundamental principles that have always underlined Buffett’s investment process. These include:

- Always stick to your “circle of competence”

- Strive to grow and deepen your knowledge over time

- Always look for a margin of safety

- Never underestimate the power of compounding

- Create the right environment to allow the miracle of compounding to work for you

- Benchmark performance against your own “inner scorecard”

- Be flexible enough to adapt your investment philosophy to changing circumstances

- Be prepared to eat your own cooking and always treat fellow investors/shareholders as partners

This is not an exhaustive list of popular but unlikely to be correct arguments against active management. Here are a few more that you may have come across:

10. There are now too many smart people investing in the market making it harder to beat.

11. Some people do beat the market, but that’s because they take more risk.

12. Warren Buffett says that Jack Bogle is his hero. I’d better do what Buffett says.

13. Even if some managers do win, you can’t pick the winners in advance.

You can find more information about these arguments on my blog: www.marketfox.org. Please send me your comments if you have any other arguments for or against active or passive investing that you’d like to add to the debate.

In part II, we’ll consider some of the more plausible reasons why active management usually delivers poor results.

__________

[i3] Insights is the official educational bulletin of the Investment Innovation Institute [i3]. It covers major trends and innovations in institutional investing, providing independent and thought-provoking content about pension funds, insurance companies and sovereign wealth funds across the globe.