If we are at the top of the tech boom, then what should investors do with their portfolios? Well, that depends on your starting point, Bellmont Securities’ Michael Block says

Earlier this month, fund manager GQG made a gutsy call: the United States technology sector is exhibiting dotcom-era overvaluation and in the next few years it will be defined by deteriorating fundamentals: lower growth, higher competition and greater capital intensity.

Essentially, GQG is calling the top of the market for technology stocks, or very nearly so.

In the research paper, “Dotcom on Steroids – When the odds appear stacked against you“, GQG points out several issues technology companies are facing and why it thinks this might cause long-term revenue growth to decelerate to single-digit growth over the next five years.

A key part of its argument is that spending on artificial intelligence (AI) has been high, while return on investment has been low or non-existent. All this investing into AI is now starting to come back and bite these companies.

“Most of today’s AI capital expenditures are funded by advertising revenue – the lifeblood of Silicon Valley. Digital advertising now accounts for more than 70 per cent of all advertising, so the penetration-driven growth story could be approaching its final innings,” the authors of the paper write.

We believe today’s CapEx is much more fragile and dependent indirectly on venture capital funding, which has had mediocre returns for a few years now. We are not seeing any signs of revenue being generated to keep fueling this spend – GQG

Advertising revenues themselves have proven to be surprisingly stable throughout history and GQG doesn’t see any reason why this might change, further adding to a limited outlook for growth.

“Despite massive innovation over the past century, total advertising revenue has remained constant at around 2 per cent of GDP, and we do not believe AI can change this fact,” the paper says.

Source: Reuters

Cloud computing and storage, another money spinner for US technology companies, is also under fire, GQG believes. Much of the cloud sector’s revenue come from AI start-ups, which spend big on computer resources. But as revenues have proven to be elusive for these start-ups, venture capital firms that are backing these companies might run out of patience.

“We believe today’s capex is much more fragile and dependent indirectly on venture capital funding, which has had mediocre returns for a few years now. We are not seeing any signs of revenue being generated to keep fuelling this spend,” the paper says.

GQG sees further signs of trouble for the cloud sector from data coming out of China. The country already seems to be experiencing a data centre oversupply, resulting in a utilisation rate of 20 to 30 per cent.

Besides, the rapid pace of technological development might reduce the useful life of assets, which could bring forward amortisation costs, as was the case with Amazon earlier this year.

“Amazon quietly reduced its useful life for its assets this past quarter due to the ‘increased pace of technology development, particularly in the area of artificial intelligence and machine learning’,” GQG says.

The Dangers of Calling the Top of the Market

So are we on the eve of the biggest mean reversion event of our lifetime?

Michael Block, Chief Investment Officer of Bellmont Securities, argues this might be the wrong question to ask.

“I’m a devotee of mean reversion and I think I can easily sell you on some parts of [GQG’s argument]. I think we all can agree that buying low and selling high is a great idea and that there is reversion to the mean,” Block says in an interview with [i3] Insights.

“But there are major caveats to that: how do you know what the mean is and how long does it take to happen? Markets tend to overshoot, both on the upside and the downside, and mean reversion can take a long time.

“And what’s the catalyst [for reversion to happen]? I’ve never seen a catalyst.”

I have a cute little bell on my desk and I tell my analysts: ‘When you think it's the top of the market, come and ring the bell’ – Michael Block

He agrees stock prices look expensive at their current valuations and in his portfolios he is underweight equities. But he is wary of anybody calling the top of the market.

“I have a cute little bell on my desk and I tell my analysts: ‘When you think it’s the top of the market, come and ring the bell,’” he says.

Needless to say, nobody has ever rung the bell.

“I have no doubt that equities are expensive, I have no doubt the tech stocks are expensive, but how long will this take to play out? I don’t know,” he says.

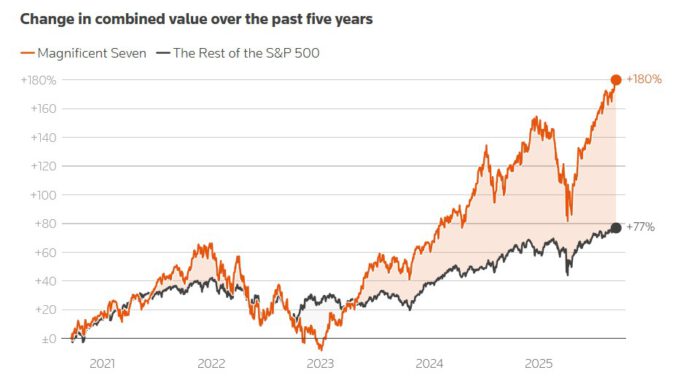

Source: Reuters, as of 18 September 2025

In his personal portfolio, Block has held an overweight position to technology stocks for the past three years, but more recently has reduced the overweight. Yet, even after taking profit (sounds better than “selling tech stocks”, he says), he still continues to hold an overweight to the sector.

“If I look across the whole world and think: ‘Where is growth going to come from?’ – well, the only place that I can see is in large-cap technology stocks,” he says.

“Are tech stocks expensive historically? Yes. Are equities expensive historically? Yes. In fact, I think everything is expensive historically. We are in a bubble of everything.

“So just saying tech stocks are expensive doesn’t make them the worst. Are they more expensive than banks in Europe, in France? I see problems all around the world. So I’m not necessarily convinced tech stocks are going to be the worst,” he says.

He recalls Jeremy Grantham’s call of 1999, when Grantham was Chair of GMO. Grantham observed price/earning ratios for the S&P 500 had reached unsustainable levels and investors would be better off choosing value stocks over growth stocks.

Grantham, who is one of Block’s personal heroes, was early in his call and it wasn’t until the early 2000s, when the dotcom bubble burst, that his prediction played out. But by then, GMO had lost a large portion of its clients, despite Grantham being right.

Eventually, GMO recovered, but it is a reminder that calling the top of the market early is a dangerous game.

Are tech stocks expensive, historically? Yes. Are equities expensive historically? Yes. In fact, I think everything is expensive historically. We are in a bubble of everything – Michael Block

Block also points out that the investment journey matters. Holding tech stocks in the past three years has been so profitable that any correction is unlikely to wipe out previous gains.

“I can afford underperformance, because I’m ahead of the pack. Even if it goes bad, we will still be better off than having held an S&P 500 index,” he says.

But your starting point as an investor is important, he says, because for an investor entering the market today, holding the S&P 500 might be a very sensible thing to do. Markets are currently so unpredictable that it is hard to make any call.

“Somebody who was starting now can just avoid the whole question and just go index weight, hold the S&P. At least, they’ll be average wherever we go from here,” Block says.

__________

[i3] Insights is the official educational bulletin of the Investment Innovation Institute [i3]. It covers major trends and innovations in institutional investing, providing independent and thought-provoking content about pension funds, insurance companies and sovereign wealth funds across the globe.