APRA has warned superannuation trustees not to use rebates as a way to pass the YFYS performance test

The Australian Prudential Regulation Authority (APRA) has warned trustees against using rebates to members to pass the Your Future, Your Super performance test.

Only seven platform, trustee-directed (Choice) products failed the test this year, compared to 37 in 2024, a reduction of 81 per cent year-on-year. But APRA noted that some products passed the test partly because rebates were applied.

“A small number of platform, trustee-directed products passed the performance test in part due to trustees’ determining to apply rebates to members. While this does benefit members, APRA will engage with relevant trustees to reinforce the expectation there is an enduring performance improvement for members,” the regulator said.

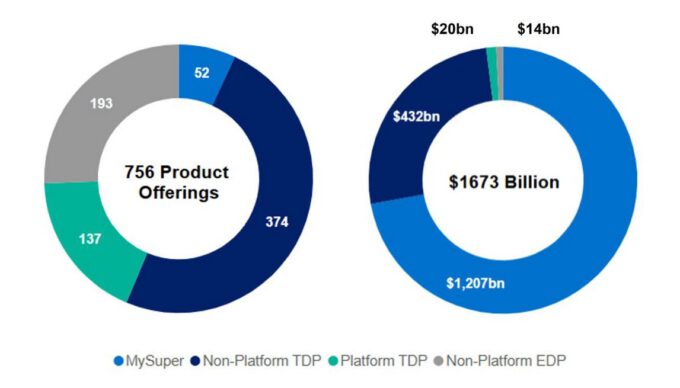

APRA pointed out that underperformance was a broader issue among the 137 platform, trustee-directed products (TDPs).

The regulator’s Comprehensive Product Performance Package (CPPP), which was released at the same time as the test results, provided additional insights into product performance by using a metric that uses a broader set of measures than those captured in the performance test.

This so-called CPPP metric compares products against a simple low-cost portfolio with a similar asset allocation and against similar products available in the market, over a 10-year period.

Based on this metric, APRA found platform TDPs showed the worst underperformance, with 41 per cent underperforming the metric by 50 basis points or more, while 35.3 per cent of non-platform, externally-directed products (EDPs) did so.

A small number of platform, trustee-directed products passed the performance test in part due to trustees' determining to apply rebates to members. While this does benefit members, APRA will engage with relevant trustees to reinforce the expectation there is an enduring performance improvement for members

Yet, these results were an improvement on the 2024 figures, when 43.9 per cent of platform TDPs underperformed and 47.2 per cent of non-platform, EDPs.

However, non-platform TDPs showed a clear deterioration of performance. In 2024, 16.4 per cent showed an underperformance by 50 basis points or more, while this year the percentage rose to 21.

“There have been significant improvements in the performance across non-platform EDPs and some improvements across platform TDPs. Despite these improvements, material levels of underperformance persist, concentrated in a small number of trustees: N.M. Superannuation with 60 per cent of platform TDPs, and Equity Trustees with 74 per cent of non-platform EDPs.

“There has been a noticeable increase in underperformance across non-platform TDPs and no material change across MySuper products,” the regulator stated.

N.M. Superannuation is the trustee for AMP Superannuation Fund and Wealth Personal Superannuation and Pension Fund, which has combined estimated net assets of $114 billion.

APRA issued directions and additional licence conditions to N.M. Superannuation in 2019 to address a range of concerns regarding compliance with the Superannuation Industry (Supervision) Act 1993. But these restrictions were lifted in August 2024 after APRA found significant improvements had been made.

Equity Trustees is currently in hot water after being sued by ASIC over its alleged role in the collapse of Shield Master Fund. The regulator raised concerns over the quality of the due diligence process applied by the trustee.

All MySuper Options Pass YFYS Performance Test Again

None of the 52 MySuper options available failed the test this year, while all 374 non-platform trustee-directed products also passed the test. MySuper products represent only 6.9 per cent of overall product offerings, but hold more than a quarter of the $4.3 trillion in total superannuation assets.

Source: APRA

“Since the introduction of the performance test in 2021, APRA has seen real progress in reducing underperformance for products subject to the performance test. The number of members in products that did not pass the test decreased from 1 million to 8,500,” Margaret Cole, Deputy Chair of APRA, said.

The median outperformance of MySuper products relative to the benchmark was 24 basis points per annum in 2025, while non-platform TDPs produced an outperformance of 35 basis points.

The medium platform TDP, however, showed an underperformance of 22 basis points, although this was an improvement on 2024, when the underperformance came in at 32 basis points.

Last week, APRA also showed that total superannuation assets had grown by 9.8 per cent to $4.3 trillion dollars, $3.0 trillion of which are regulated by APRA, while $1.0 trillion sits in self-managed super funds.

Total contributions to super funds increased by 14.1 per cent to $210.2 billion, or $17.5 billion a month. The level of total benefit payments rose by 12.8 per cent to $132.5 billion, leaving a net inflow of $70.5 billion in 2025, up 13.8 per cent from last year.

__________

[i3] Insights is the official educational bulletin of the Investment Innovation Institute [i3]. It covers major trends and innovations in institutional investing, providing independent and thought-provoking content about pension funds, insurance companies and sovereign wealth funds across the globe.