The financial year 2025 has been another stellar year for Australian superannuation fund returns, but what lies underneath the headline figures?

Over the last couple of weeks, superannuation funds have started to report their returns over the full 2025 financial year. And while we should acknowledge that 2025 has been a great year from a return perspective, everyone wants to know who has done best, of course.

But returns are not always easy to compare.

For instance, take the funds that have traditional diversified options, such as Balanced, Growth and High Growth, and compare them with funds that use a lifecycle approach. Often, lifecycle approaches have a large number of cohorts, with pools becoming increasingly more conservative in the risk they take as the member gets older.

But which pool do you compare with a Balanced or Growth option? Often, multiple lifecycle options fit the description of a Balanced option.

Then there is the question of how you define a Balanced or Growth option. Rating agencies use different definitions. Chant West, for example, says a Balanced option has between 41 and 60 per cent in growth assets, while SuperRatings says it is 60 to 76 per cent in growth assets. Allocating 41 per cent to growth assets or 76 will result in vastly different returns.

If we take the definitions used by SuperRatings, which seems to be the method applied by the majority of super funds, then a High Growth fund is a fund that has between 91 and 100 per cent of its assets allocated to growth assets.

A Growth fund, by this methodology, has between 77 and 90 per cent in growth assets, while a Balanced fund has 60 to 76 per cent growth assets. A Conservative Balanced fund has 41 to 59 per cent in growth assets.

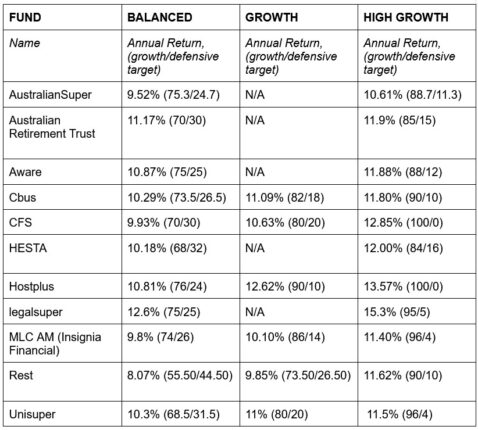

2025 Reported Returns So Far

Source: Investment Innovation Institute [i3]

Taking this into account explains why the Balanced option of super fund Rest has not performed as well as the Balanced options of other super funds.

The Rest Balanced Fund has an asset allocation split of 55.50 per cent growth assets and 44.50 per cent defensive. According to SuperRatings, that really makes it a Conservative Balanced option rather than a standard Balanced option.

Comparing Rest’s option against Aware Super’s Balanced option, which has 75 per cent in growth assets and has done 2.8 per cent better over the year, wouldn’t be appropriate as the two funds have vastly different risk profiles.

Similarly, funds don’t do themselves justice when it comes to High Growth options. What most funds label as High Growth, is really a Growth option by SuperRatings’ definitions.

In fact, both the Growth and High Growth options of most superannuation funds fall within the same Growth category, according to this rating agency.

Only Colonial First States’ and Hostplus’ High Growth options are a true High Growth option, with almost 100 per cent of its assets allocated to growth assets, mostly equities. And they have performances to match their risk profiles: 12.85 per cent for CFS and 13.57 per cent for Hostplus for the year.

Strong Performers, Risk Adjusted

Another outlier in this year’s result is HESTA. Its Balanced option returned 10.82 per cent for the year, in line with the average balanced fund performance, but it managed to achieve this with a target asset allocation of 68/32, while most other funds have at least 70 per cent in growth assets and often much more.

For example, AustralianSuper’s Balanced option returned 9.52 per cent, but did so with 75.3 per cent in growth assets.

HESTA has 19 per cent of its assets in a bucket called Global Debt, which includes a wide range of fixed income instruments, not all of them low risk, and one could be forgiven for thinking there might be a lot of private debt in here.

But [i3] Insights understands the fund only has a 0.6 per cent allocation to private debt, not nearly enough to explain the impressive performance.

The fund itself attributed the strong return to prudent liquidity management and stress testing, which allowed HESTA to ‘take advantage of long-term buying opportunities during the periods of market volatility’.

The Australian Retirement Trust also had a stellar year. Although its Balanced option has 70 per cent in growth assets, slightly higher than HESTA, it returned 11.17 per cent, while its High Growth option (Growth according to SuperRatings) even did 11.9 per cent for the year with relatively modest 85 per cent in growth assets.

A note must be made about the use of asset allocation numbers in fund product disclosure statements (PDS). Most of the time, these are target asset allocations, and the real split might differ during the year, in some cases quite significantly so.

Take Aware Super, for example. Its High Growth option has a target asset allocation of 88 per cent, but it states in the PDS that it can go all the way to 100 per cent growth assets, a 12 per cent tilt!

These days, members can look up the current asset allocation of the option in more detail and find out all the underlying holdings of the fund. But even then, funds don’t always classify growth assets in the same way.

Key Takeaways

Despite the differences, most funds had a very strong year in 2025, perhaps surprisingly so after double-digit returns in the previous two years and considering 2025 included a trade war and escalating confrontations in the Middle East.

Funds with a higher allocation to passive investments seemed to have done better across the board, as active managers struggled with some of the concentration in equity markets.

For example, in Australia, Commonwealth Bank of Australia (CBA) saw its stock price increase by 46 per cent over 2025 and is now among to most expensive banks in the world. But active Australian equity managers tend to be underweight domestic banks in their portfolios.

Funds with higher weightings to CBA would have performed slightly better in their equity books. And weightings can differ quite a bit.

Looking at portfolio holding figures from 31 December 2024, the most recent available, and ART’s Diversified Balanced option held 2.32 per cent in CBA. In comparison, Rest’s Balanced option held 1.06 per cent CBA shares, less than half the weighting of ART’s portfolio. HESTA had a 2.08 per cent weighting to CBA in its Balanced Growth option.

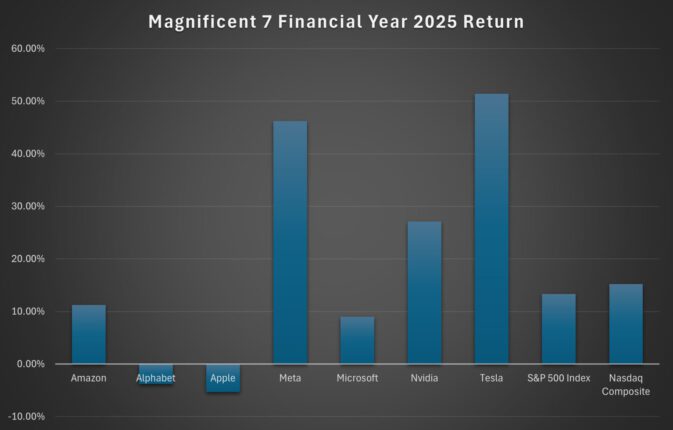

In the United States, the Magnificent Seven showed a much more dispersed performance compared to their dominating position in 2024.

Apple lost five per cent over the year, while Alphabet tumbled almost four per cent. Microsoft and Amazon performed slightly below the market average.

But Tesla has shot the lights out with a 51 per cent price increase, despite the turbulence around Elon Musk’s role in the Trump administration and his subsequent departure as Head of DOGE.

Source: Investment Innovation Institute [i3]

Meta also did surprisingly well at plus 46 per cent, while Nvidia showed a pretty decent 27 per cent price increase.

Picking Tesla and Meta over Microsoft and Alphabet wasn’t necessarily a clear choice when looking at the companies’ fundamentals. But the companies’ weightings in equity books would have made a difference at the margin.

Rest is relatively light on Tesla in its Balanced option, with a weighting of 0.28 of the total portfolio. ART holds 0.34 per cent in Tesla in its Diversified Balanced Option, while HESTA holds 0.33 per cent.

Rest is much more aggressive in its High Growth option and holds 0.54 per cent of the portfolio in Tesla, compared to 0.36 per cent in ART’s Diversified High Growth option. Rest’ higher risk appetite in its High Growth option might explain why this option has performed largely in line with other funds, in contrast to its Balanced option.

Can We Continue This Winning Streak?

Three years of high single-digit and double-digit returns are an impressive performance on any measure. The question is now whether this performance can be repeated in the 2026 financial year.

Consecutive periods of double-digit returns are not unheard of, but become rare once you look at periods of more than three consecutive years.

But then again, we have been hearing for the last 15 years that returns are going to be lower for longer, yet 11 of those years saw double-digit increases in the S&P 500.

Perhaps we are at the forefront of a new productivity boost supported by artificial intelligence and the streak of double-digit returns will continue. Perhaps not.

In the end, good, persistent performance is more a matter of prudent risk management than opportunity chasing, and a well-diversified portfolio seems like a good choice in any market environment.

__________

[i3] Insights is the official educational bulletin of the Investment Innovation Institute [i3]. It covers major trends and innovations in institutional investing, providing independent and thought-provoking content about pension funds, insurance companies and sovereign wealth funds across the globe.