Diversification is an age-old tool in investment risk management, but has seen many different iterations over time. We speak to JANA’s Justin Tay about the next evolution of diversification in manager selection, looking at behavioural finance, manager processes and time horizons.

The idea of diversification to reduce an investment portfolio’s risk profile has been around for a long time, even well before Nobel Prize winner Harry Markowitz wrote his seminal paper on the subject in 1952.

The phrase, “Don’t put all your eggs in one basket”, has been around since at least the 17th century and likely much earlier.

For example, this proverb can be found in early translations of Spanish novel Don Quixote by Miguel de Cervantes, although it is likely to have been introduced into the English language from the Italian phrase: “Porre tutte l’ova in un paniere.”

But despite its ancient origins, ideas about diversification continue to change and the approach to risk management in investing has become increasingly granular as more data becomes available and analytical tools continue to evolve.

Markowitz’s contribution to the topic was the realisation that a portfolio’s risk profile is not just determined by the average level of risk of the individual assets, but by the degree to which the returns on those assets move together.

He argued benefits could be had from not just holding a lot of stocks, but from holding different types of investments across countries, sectors and asset classes.

Academics and investors have been building on Markowitz’s ideas and have shown portfolios can further benefit from diversification across different investment styles and factors, such as growth, value, quality and momentum.

It is about drilling down a couple more layers to understand what the true nature of the exposure is that you're getting in the portfolios. And then how does that complement broader parts of your portfolio

This constant evolution is not just an intellectual indulgence, it is a necessity, because correlations between assets change.

For example, research by UBS found the correlation between the individual developed markets has significantly increased over time under the influence of globalisation.

Since 1974, the average correlation between developed markets more than doubled from 0.37 in the early 1970s to 0.75 today, while the correlation with emerging markets increased from 0.05 to 0.49.

In other words, institutional investors today do not get the same level of diversification from investing in international stocks as they did in the 1970s.

For this reason, investors are constantly on the lookout for new and different sources of diversification and the next frontier of diversification is about incorporating the human element into investing, in particular when using external fund managers.

Learnings From Behavioural Finance

Behavioural finance has made a splash in recent years, with academics Daniel Kahneman and Amos Tversky introducing the world to behavioural biases, including loss aversion and anchoring.

But until recently, few investors have been successful in incorporating these concepts into the way they construct portfolios.

That is about to change.

With the help of new analytical platforms, JANA has now developed a practical way to assess how these behavioural elements affect a fund manager’s investment behaviour and what this means for alpha generation.

A key finding was the identification of significant differences between managers that on paper looked to have similar styles and operated in the same markets, but in practice had radically different investment processes.

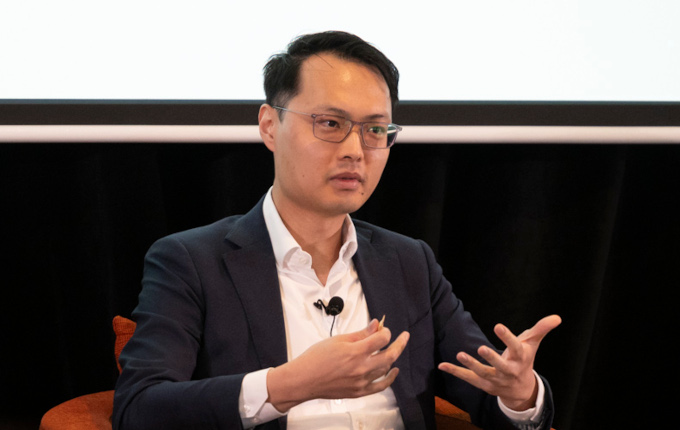

“You’ve got deep-value managers, which are fishing in the bottom quintile of the valuation spectrum within the market. These deep-value managers are prepared to be very patient, where they are prepared to wait, call it five years, for their insights to play out,” Justin Tay, Head of Global Equities at JANA, says in an interview with [i3] Insights.

“On the other hand, you’ve got value managers who are a little bit more catalyst driven. So in each position that they put on, they need to see clear markers over a medium-term horizon, say three years instead of five, for example.

“And whilst there could be some overlap in terms of risk/return characteristics, the pay-off profiles can be quite distinct between these two different approaches.”

Analysing different manager skill sets allows investors to achieve greater diversification across investment time horizons and alpha cycles, while it also allows for more granular diversification across investment styles.

“It is about drilling down a couple more layers to understand what the true nature of the exposure is that you’re getting in the portfolios. And then how does that complement broader parts of your portfolio.” Tay says.

Translating Trade Data into Behavioural Signals

The availability of more data, particularly on historic trading patterns of managers, is a key part of the reason why this form of diversification is now available.

For example, JANA now incorporates an analytical framework from Cabot Investment Technology that looks for a number of fund manager behavioural biases in its assessment, including risk aversion, loss aversion, regret aversion and the endowment effect.

“What these analytic packages enable us to do is basically take all of the investment decisions that a manager has made historically and it slices and dices it in multiple different ways,” Tay says.

“There are certain biases that investors could be vulnerable to. For example, a manager that tends to have a high-quality-oriented investment approach, a buy-and-hold, long-term compounding approach, quite often will be subject to the endowment effect, where they can fall in love a little bit with names that they’re very familiar with.

“And in those sorts of situations, you may not be holding your existing or long-standing names to the same standard as you would for a new name entering the portfolio. Often they would be aware of [this danger]. But when you have an analytic package that is objectively telling you so, I think it does help a little bit in terms of keeping it more front of mind when you’re making decisions.”

The aim is not to try and eradicate all human biases, but to be aware of their existence and diversify across manager behaviours in the portfolio.

There are certain biases that investors could be vulnerable to. For example, a manager that tends to have a high-quality-oriented investment approach, a buy-and-hold, long-term compounding approach, quite often will be subject to the endowment effect, where they can fall in love a little bit with names that they're very familiar with

“Even within the same style, you can get process and time-horizon diversification,” Tay says.

“Now clearly, the very short end is typically the space where quants do better because they’ve got significant breadth and multi-factor signals, many of which are momentum factors that tend to be a bit shorter term in horizon.

“But that’s not to say there aren’t fundamental managers who think over a 12 to 18-month horizon as well.”

Ultimately, it is all about intentionality and awareness of these behaviours when selecting managers.

“When you’ve got more understanding of the strengths and potential areas for improvement, and how that interacts within the broader portfolio, then there are opportunities there for further optimisation,” Tay says.

Monitoring Behavioural Change in Managers

Although manager processes tend to evolve over time, their underlying approach to investing generally doesn’t change too much. After all, good managers don’t show high levels of style drift.

But human behaviour can change over time and this could affect the level of diversification between managers.

Tay says this means investors will need to assess whether earlier identified behavioural characteristics are still there as part of their continued manager monitoring.

“It is something which needs to be part and parcel of your due diligence and your ongoing monitoring of the manager because you need to make sure that those exposures can be depended upon with confidence,” he says.

“For example, when you’re researching a manager, ask what the alpha time horizon that they’re looking to target is. Has that manifested in practice to the extent that there’s a discernible track record that you can observe? Is the investment team structured appropriately to be able to deliver that type of risk/return profile?

“These are things you can look out for that structurally give you protection.”

__________

[i3] Insights is the official educational bulletin of the Investment Innovation Institute [i3]. It covers major trends and innovations in institutional investing, providing independent and thought-provoking content about pension funds, insurance companies and sovereign wealth funds across the globe.