In this opinion article, Annika Bradley, Senior Manager at UniSuper, takes a closer look at how superannuation funds can mass-customise advice for retirees

The drums are beating for super funds to provide cost-effective, personalised advice for Australians. But is personalising an investment recommendation at scale possible?

Can the trusty old fact-find and risk questionnaires really serve investors at scale? Let’s take a look at the industry’s main operating models; the key components of providing investment advice; and the challenges of replicating the human experience.

Right now, the industry’s three main avenues for personalised investment recommendations are:

- default lifecycle products: anchored to age and requiring scalable rebalancing functionality;

- adviser-directed: underpinned by a fact-find and risk questionnaire; and client meetings to tease out investor trade-offs and preferences; and

- member-directed: the member chooses based on their individual circumstances and information available from the product provider

Three very different operating models and cost structures — do any of these achieve the goal of personalising investment advice at scale?

Leveraging The Adviser-directed Model for Scaled Investment Advice

The regulatory guidance[1] on providing “advice on financial products with an investment component” makes it clear that the “client’s objectives, financial situation and needs (including tolerance for risk)” should be considered.

Lifecycle products don’t factor tolerance for risk and a member self-directing doesn’t always cut it. That leaves the adviser-directed model, but as we know there just aren’t enough advisers to go around.

So can the model be scaled?

The adviser-directed model is powerful, not least because the trust built over time provides a foundation for the advice, but it is part art, part science – making it tricky to replicate at scale

The adviser-directed model is powerful, not least because the trust built over time provides a foundation for the advice, but it is part art, part science – making it tricky to replicate at scale.

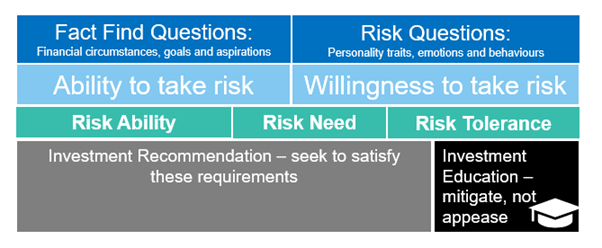

The main tools underpinning the process are the fact-find and risk questionnaires. The information elicited by these tools to provide investment advice can be broadly split into two categories: risk tolerance and risk ability.

The Key Ingredients: Risk Tolerance and Risk Ability

An investor’s risk tolerance[2] is their willingness to experience a less favourable outcome in pursuit of an outcome with more favourable attributes.

There’s plenty of debate amongst the academic literature about risk tolerance including:

- how well risk questionnaires actually estimate risk tolerance (validity and reliability);

- how other types of behavioural risk (e.g. risk composure or risk perception) can play a part in investor outcomes;

- how stable it is through time (tolerance is considered stable, but risk perception can change depending on market conditions – unsurprisingly investors often become reluctant to take risk when markets are falling sharply);

- how influenced it is by past experiences or gender; and

- how much weight it should be given when recommending an asset allocation mix

On the other hand, “risk ability” (or “risk capacity”) is far less controversial, yet a recurring theme is inadequate emphasis is placed on it when personalising an investment recommendation. Risk ability evaluates an individual’s ability to withstand declines in portfolio values[3]. The components (including goals-based factors, which are sometimes separated into a “risk need” category) are:

- investment time-horizon;

- liquidity needs;

- the investable asset base and the investment strategy applied to it (e.g. term deposits or shares);

- future earnings; and

- future spending rates and goals

It’s a more wholistic view of the investor’s circumstances.

There is limited agreement amongst practitioners, academics and global regulators as to the perfect proportions between risk ability and risk tolerance factors, but the illustration below provides a framework[4].

Personalising An Investment Recommendation Using Risk Ability and Risk Tolerance

Setting aside how to optimise between risk tolerance and risk ability, a well-designed retirement income calculator and a risk questionnaire could provide all the required information to achieve our goal, couldn’t it?

The Challenges Of Replicating The Human Experience

Maybe not. The ‘art’ of financial advice can be hard to replicate in a pure digital setting (required to achieve scale). Let’s take a look at the challenges:

- Number of questions asked: a lot of information is required to form a wholistic view of an investor’s circumstances. In a digital setting, it’s assumed abandonment rates increase with more questions and the opportunity for a ‘follow-up’ question proves difficult. It’s a balancing act between gathering ‘critical’ information and maximising the chance of the investor staying engaged

- Consistency of responses: inconsistent answers might indicate an investor’s lack of understanding or that they are simply not prepared to accept the risk return trade-offs involved. Many risk profiler tools let you answer inconsistently, but still provide a result

- Trade-offs: achieving a financial goal requires trade-off – with many levers to pull. You can spend less, save more, work longer and take less risk. You can accept market fluctuations to increase your chances of having more in retirement. You can take less holidays in retirement. The list goes on… Some retirement calculators do a great job of revealing these trade-offs but not all do

- Education during the recommendation process: like asking the right number of questions, providing the right amount and type of content to educate through the process is a balancing act. Incorporating relevant and engaging education to aid the investor’s understanding is best practice, but needs will vary

- Nudges: steering investors to better outcomes is a critical part of advice but homing in on the right ‘nudge’ without an adviser present, can be challenging

- Education during the investment time horizon: managing investor behaviour is an ongoing commitment. Reassuring them when markets are going down; nudging them to revisit the advice as their circumstances change; and celebrating them when they stick to their plan is part of the ‘human’ factor

- Regulatory environment: scaled advice is relatively new and the regulatory landscape continues to evolve to support delivering quality, affordable advice to Australians

Inching Towards Cost-effective, Personalised Advice

The laundry list of challenges gives you an insight into why scaled investment advice has not yet been nailed. It isn’t easy. But the industry push into digital advice has begun.

Offering investors a ‘hybrid’ approach to scaled advice is a good stepping stone. If an investor really needs to clarify a question, concept or trade-off; or if they want the validation of the outcome from a human – having an adviser step in will help.

The adviser-directed model is powerful, not least because the trust built over time provides a foundation for the advice, but it is part art, part science – making it tricky to replicate at scale

The building blocks are there. Leveraging a fact-find and risk questionnaire provides a solid foundation. The right balance between an investor’s risk ability and tolerance must be struck to arrive at sensible outcomes. And it’s then about testing for investor consistency and understanding; revealing the trade-offs; providing engaging education during and after the recommendation; and sensibly nudging the investor to stay the course and revisit the advice when appropriate.

Cost-effective, scaled advice is possible – it just requires us to think differently about the trusty old tools that have served advisers for the last few decades. Of course, once scaled personalised investment advice is nailed, the next frontier is scaled personalised withdrawal rates.

Annika Bradley is Senior Manager with Unisuper. Bradley will chairing the session ‘Delivering Advice & Retirement Outcomes at Scale’ at the [i3] Investment Strategy Forum, which will be held on 8 – 9 May, 2025, in Torquay, Victoria.

[1] RG 175 AFS licensing: Financial product advisers—Conduct and disclosure

[2] Grable, John: Financial Risk Tolerance: A Psychometric Review

[3] Grable, John: Financial Risk Tolerance: A Psychometric Review

[4] Davis, Greg: New Vistas in Risk Profiling (adaptation of original exhibit: Investment Planning Using Risk Capacity and Risk Tolerance)

__________

[i3] Insights is the official educational bulletin of the Investment Innovation Institute [i3]. It covers major trends and innovations in institutional investing, providing independent and thought-provoking content about pension funds, insurance companies and sovereign wealth funds across the globe.