We are in a bubble-of-everything, but the concerns over private credit are overblown, Michael Block writes

I am very reluctant to use the word bubble.

I usually reserve that for West Ham footy games (despite the fact that I am a lifelong Liverpool FC fan. #YNWA )

Nevertheless, I wonder whether we are in a ‘bubble of everything’ and when normal transmission will resume.

Many people believe that current market volatility is due to Trump-o-nomics and tariffs and that most daily market moves can be explained by a quick sound bite attributing them to recent prints in inflation, unemployment or rates.

I do not agree with that and think most short-term movements are just market noise.

I am also a card-carrying devotee of mean reversion and as such I believe that the strategy of buying low and selling high is still worth considering.

Looking back over centuries, all but one asset has mean reverted over time. And that asset is, … drum roll …, you guessed it:

Australian residential house prices.

Unfortunately, believing in mean reversion is one thing, determining the mean is a whole different kettle of fish.

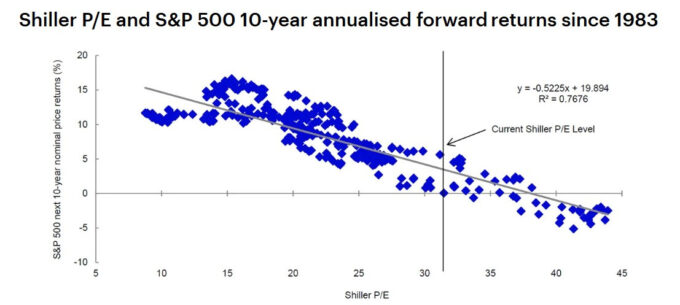

Take Global Equities for example. (American economist) Robert Shiller’s cyclically-adjusted price/earnings ratio (CAPE) remains, in my opinion, the best indicator of future equity returns.

Over the past 100 years, it has an average of 16.4 times, and was recently at over 30 times. If it were as simple as selling equities and waiting for share prices to fall, then I would be in Monaco and could send you a postcard.

Unfortunately, I remain a humble academic and adviser. Predicting turning points is super hard.

I have been practising market timing for over 40 years and have a good track record. But just like one of my heroes, Howard Marks (Co-chairman) of Oaktree, my record is good because I have only made around a dozen calls over 40 years. And all of them have been when markets were at extremes.

Howard Marks says he’s made five great market calls in his career. If we look at a line of best fit (mean squares regression) below it is pretty clear that there is a strong long-term relationship between elevated share prices and low future returns.

Source: LSEG Datastream, Robert Shiller, Invesco Global Market Strategy Office

So, I think that if this relationship holds then future equity returns are likely to be lower than the past 30 years or so.

However, because the CAPE average includes two world wars, the Global Financial Crisis, the great depression and COVID-19 maybe the 16.4 average is a tad low.

Nevertheless, there is no argument that share prices are at historically high levels (even after the recent falls). So let me look into my crystal ball and see if I can make sense of markets and predict the future (and you do not have to cross my palms with silver so take this advice for what it is worth!)

Here is what I am thinking:

(1) I have seen elevated markets before in most asset classes but never everything, everywhere all at once. I do not understand why all assets are at elevated prices just as I could make absolutely no sense of the award-winning movie of the same name

(2) My best guess is that we are in a bubble-of-everything where asset prices have got ahead of earnings and as a result lower returns will follow.

(3) This view allows me to make sense of two things.

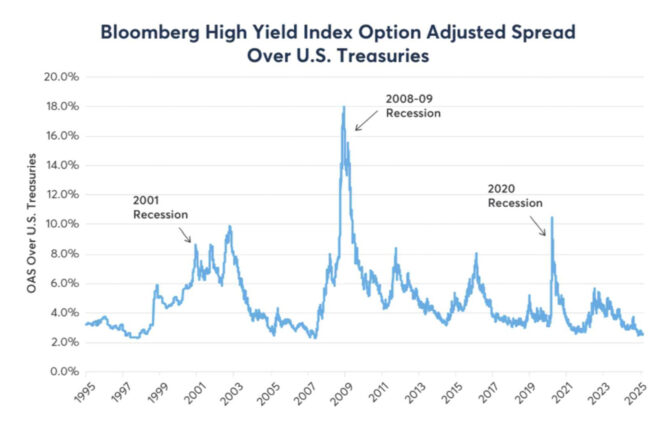

- Firstly, why High Yield spreads are so low; and

- Secondly, why all roads lead to credit strategies, including and especially private credit

(4) Let me explain.

At first, I could not understand why anyone would buy HY debt at around only 2 per cent over swap. You can quote me as saying that I would no sooner do that that fly to the moon.

Source: Bloomberg

However, I can explain it away thus. If equity return expectations are low (equity risk premium (ERP) of 4 per cent or so), then an instrument that is around 50 per cent equities should trade at a margin of 2 per cent. Ergo, high yield at only 200 bps over treasuries.

(5) If we continue in this vein, given that equities and equity-like assets are so expensive then what can we possibly find to earn a fair margin over cash without taking too much equity risk?

Credit. There is no alternative. TINA. There really is no alternative. TRINA.

(6) So, just as adding investment-grade credit to a portfolio makes sense so does replacing some equities with private credit.

(7) If one sticks with good managers with good processes, then I think private credit can achieve higher risk-adjusted returns than equities and maybe even higher absolute returns than equities.

Vive la révolution!

(8) PS, a footnote. There has been tons of negative press around a certain market-leading private credit manager. I still think that by whatever metrics one uses, that manager is demonstrably a good manager. So whether it be tall-poppy syndrome or based on personality issues, in my opinion, detractors should stick to bagging the loads of rubbish private credit strategies that are out there rather than having a go at the good ones.

Private credit is here to stay whether you like it or not. Do not listen to all of the Jimmy Numnuts out there that bag all private credit rather than being discerning.

Michael Block is Chief Investment Officer of Bellmont Securities. The views and opinions expressed in this article are those of the author and do not necessarily reflect the views or positions of their employer or of the Investment Innovation Institute [i3].

__________

[i3] Insights is the official educational bulletin of the Investment Innovation Institute [i3]. It covers major trends and innovations in institutional investing, providing independent and thought-provoking content about pension funds, insurance companies and sovereign wealth funds across the globe.