At a recent Association of Superannuation Funds of Australia (ASFA) meeting, a room full of super fund executives grappled with a challenge that’s becoming increasingly difficult to ignore: how to maintain meaningful member engagement as their funds continue to grow at an unprecedented pace.

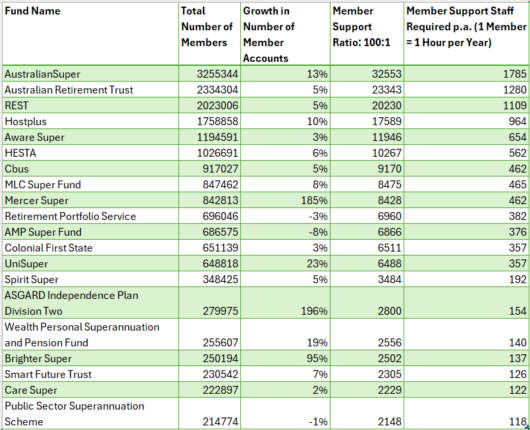

The figures speak for themselves. AustralianSuper, for instance, closed out 2023 with 3.2 million members—a number that’s been rising by 13 per cent annually. If they aimed to spend just one hour per year with each member, they’d need to hire 1,785 full-time advisors.

To put that into perspective, that’s more than the entire financial advisory workforce in Australia.

As these super funds merge and expand, the notion of providing personalised, one-on-one financial advice is slipping further out of reach. Traditional methods of engagement – phone calls, face-to-face meetings, workshops, or member events – are no longer sufficiently scalable.

The larger these funds grow, the less capable they become of delivering the kind of individual service that is required if they are to do anything more than pay lip service to member engagement.

Source: Evolved.AI

This problem brings into sharp contrast the difference between the economies of scale in managing more money, which arguably is the foundational business model for all asset owners and asset managers, and the diseconomies of scale in managing more members.

This isn’t merely a logistical issue; it’s a significant shift in how super funds must approach member interaction. The personal touch, featured in the ethical guidelines of these organisations, seems increasingly out of reach. The technology that is being invested in and pursued is more about the operational problems arising from managing and moving around large amounts of money, than it is about providing higher quality and more personalised member engagement.

Language models have the capability to work with other systems to provide tailored communications to each member of a super fund, incorporating and responding to some of their queries

Enter generative artificial intelligence (AI), a technology that, while often misunderstood, holds the potential to bridge the growing gap between scale and personalisation. Language models have the capability to work with other systems to provide tailored communications to each member of a super fund, incorporating and responding to some of their queries.

A kind of ‘advice light’ model that, while erring shy of providing holistic advice, could still go a long way to providing value to the largely under-advised segment of the Australian population.

The implications are profound for how super funds have to expand their capabilities and technology stack. As they grow, the pressure to adopt new technologies capable of keeping pace with an expanding member base will only intensify. Generative AI won’t be a luxury to be debated at conferences, but a necessity for member engagement. In a landscape where the numbers are overwhelming, it offers a pathway to sustainable, meaningful engagement.

While historically technology adoption and systematic automation has been a test for most super funds, their growth must necessitate a more systematic and sophisticated approach to how they help millions of Australians understand and plan for their retirement.

Michael Kollo is Chief Executive Officer of Evolved.AI. The opinions stated in this article are his own and do not necessarily reflect the opinions of the Investment Innovation Institute [i3]

__________

[i3] Insights is the official educational bulletin of the Investment Innovation Institute [i3]. It covers major trends and innovations in institutional investing, providing independent and thought-provoking content about pension funds, insurance companies and sovereign wealth funds across the globe.