As the full year results come in, it seems that exposure to The Magnificent Seven was a key driver of super fund returns

As the full year investment returns of Australian super funds come in, it becomes clear that the most important call in the 2024 financial year was a fund’s exposure to the so-called Magnificent Seven.

The Magnificent Seven refers to a group of very large technology companies, including Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia and Tesla.

The term ‘The Magnificent Seven’ was coined by Michael Hartnett, Managing Director and Chief Investment Strategist at Bank of America Global Research, in a research note in May 2023.

The best performing options across super funds were the single asset class, international equities options, which is the asset class with the highest exposure to The Magnificent Seven

Hartnett’s moniker is a reference to the 1960s Western ‘The Magnificent Seven’, directed by John Sturges, about a group of seven gunslingers who are trying to protect a Mexican village from bandits.

The film is itself a remake of the 1954 Japanese movie ‘Shichinin no Samurai’, or Seven Samurai by Akira Kurosawa.

The stocks are considered magnificent, because they have dominated not only the US equity market, but global equity markets too, through a combination of the companies’ size and the large gains they have posted over the year.

For example, Nvidia closed the 2024 financial year at a share price of US$123.54, 291 per cent higher than the US$42.40 price at the start of the year. The company now has a market cap of almost US$3 trillion.

Apple has a market capitalisation of US$3.5 trillion and now represents 10 per cent of the Nasdaq.

Impact on Super Funds

The dominance of The Magnificent Seven is so great that their influence is also clearly visible in the return figures of the various investment options of Australian superannuation funds.

Take Unisuper, for example. The fund’s Balanced option returned 9.2 per cent for the year to 30 June 2024, while its Sustainable Balanced option returned 12.2 per cent.

The fund’s sustainable option has a number of exclusions around fossil fuels, which meant it was underweight energy and materials, two sectors that didn’t perform too well last financial year, but it also results in a heavier skew towards technology stocks, which paid off handsomely.

Looking across funds and a similar picture emerges. The best performing options across super funds were the single asset class, international equities options, which is the asset class with the highest exposure to The Magnificent Seven. Some indexed international equity options returned more than 18 per cent over the year.

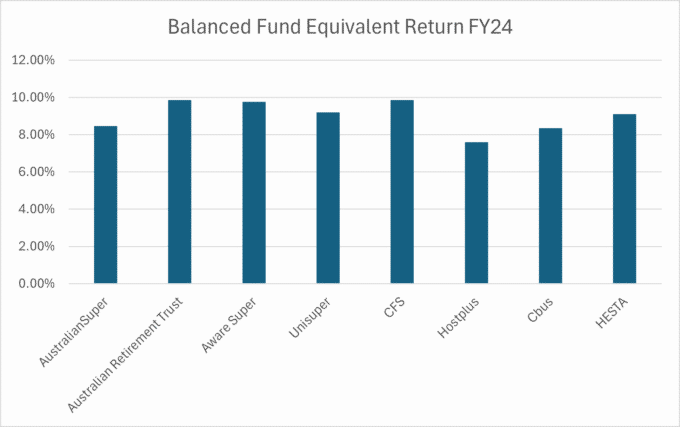

Reported balanced option returns of largest public offer super funds. Source: super fund websites

If we compare balanced fund options between the various super funds, then we can also see here that funds with a greater exposure to the Magnificent Seven produced higher returns.

For example, the Australian Retirement Trust (ART) has a total exposure to The Magnificent Seven in its balanced fund (diversified fund option) of 2.89 per cent. ART’s Balanced option returned 9.86 per cent over the year to 30 June 2024.

Hostplus has a lower exposure to The Magnificent Seven in its balanced option at 1.39 per cent in total. The performance of its Balanced option is, therefore, also lower at 7.60 per cent.

The dominance of The Magnificent Seven was the most pronounced last year, but their influence has been noticeable over at least the last decade.

Calculations by Vanguard showed that a hypothetical portfolio tracking the Russell 3000 Index while excluding The Magnificent Seven would have lagged the index by approximately 2.1 percentage points a year over the past 10 years

But as we know, past performance is no guarantee of future performance. And the cracks in the dominance of The Magnificent Seven are already starting to show.

Share prices of The Magnificent Seven have started to show some weakness last week, while the global IT outage as a result of a faulty update by CrowdStrike has dealt a blow to the confidence of investors in the technology sector.

There are also increasing concerns over the ability of artificial intelligence (AI) to deliver on its promise. AI, especially the training of large language models, takes a lot of capital expenditure, while it isn’t clear whether any new AI-driven features will translate into greater profitability.

This week, we will see the first of The Magnificent Seven companies, Alphabet and Tesla, report their second-quarter earnings and perhaps this will give an indication of whether their dominance is likely to continue or whether we will start to see some mean reversion taking place.

__________

[i3] Insights is the official educational bulletin of the Investment Innovation Institute [i3]. It covers major trends and innovations in institutional investing, providing independent and thought-provoking content about pension funds, insurance companies and sovereign wealth funds across the globe.