In this opinion article, George Lin draws on his extensive experience in fixed income investing and examines the role this asset class plays in portfolio construction. Lin argues there are many misconceptions about the various sub asset classes and the return assumptions for each of these.

Fixed interest as an asset class is a key building bloc in most Australian investors’ portfolios. Yet it receives relatively less attention than growth assets from both investors and intermediaries. It is widely assumed that the only purpose of the asset class is to “play defense“ in a multi asset portfolio, although the definition of defensiveness is often vague.

Many investors seem content to chase yields or higher returns without fully appreciating the trade-off. Furthermore, many asset owners also assume the asset class has very limited opportunity to generate consistent active return. While all those assertions have some elements of truth, they are also misleading.

It is widely assumed that the only purpose of the asset class is to “play defense“ in a multi asset portfolio, although the definition of defensiveness is often vague

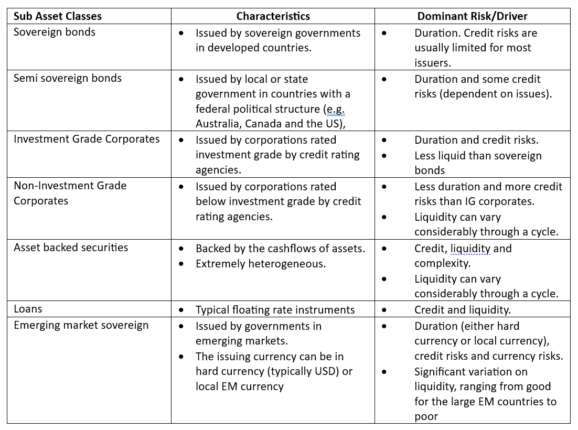

A starting point to manage or build a fixed interest portfolio is to recognise that fixed interest assets are more heterogeneous in nature than equities. In many ways, fixed interest assets are “multi assets” in their own rights. The global fixed income universe can easily be divided into at least 7 or 8 sub asset classes which have different risks, return and liquidity.

The following table outlines a very generic breakdown of the fixed interest universe, from the most defensive (as measured by volatility and expected returns) to the most aggressive. Investors can construct vastly different portfolios, dependent on their risk and return preferences.

Overview of Fixed Interest Sub Asset Classes

“There is no free lunch” is the first rule in finance and is equally applicable in fixed interest. If an investor starts with a blank piece of paper and is totally benchmark agnostics, the safest fixed interest assets are short term, sovereign bonds issued by developed economies which have limited credit risk and duration.

If managers’ skills are ignored, investors need to either take greater credit risks, or assume more durations risks, or take some form of liquidity premia and complexity (model) risks in order to generate higher returns. In the long run, those risk premia tend to generate excess returns but they can also generate significant short term variability in returns.

The challenge for most investors is that those risk premia, with the possible exception of duration, are pro cyclical and tend to increase when risk aversion rises and the economic cycle is troughing. Investors expect steady returns from fixed income but are often surprised that those fixed income risk premia perform poorly or even generate negative return when equity markets correct.

Investors expect steady returns from fixed income but are often surprised that those fixed income risk premia perform poorly or even generate negative return when equity markets correct.

Furthermore, experience during both the global financial crisis and the pandemic also taught us that liquidity in fixed interest markets can evaporate rapidly in episode of market stress. If an investor counts on using her fixed interest exposures to provide liquidity, she should be prudent on the portfolio’s exposures to credit, liquidity and complexity risks.

While duration is often not pro cyclical, investors should be aware that duration is not a perfect diversifier versus equity market cycle under all market circumstances. Duration only generates positive return when inflation is de-accelerating and expected inflation is falling. When inflation accelerates (in 2022) or when inflation expectations are at risk of de-anchoring, duration can contribute negatively to fixed interest return.

The key to building an effective fixed interest portfolio is similar to that of building a multi asset portfolio. It starts with defining and quantifying the objective function and understanding the major investment constraints.

The main objectives of investing in fixed interest assets are as follow. Firstly, the portfolio needs to generate income and return. Secondly, the fixed interest portfolio should be diversifying to equities. Thirdly, to provide sufficient liquidity especially at a time of market dislocation.

While it is easy to state and articulate those principals, even highly experienced investors have a tendency to focus on improving expected returns while de-emphasising the other considerations. There is a general tendency to downplay the trade-off between return, diversification and liquidity.

Investors, in my view, should recognise that a trade-off between those objectives is inevitable and be as explicit as possible in making this trade off. Investors should also have clearly stated liquidity constraints and actively monitor liquidity. Finally, investors should be careful with the output of quantitative models based on historical events. Those models often provide a false sense of safety!

This is not an argument against having exposures to credit (even non-investment grade credit) or emerging market debt or securitised assets or bank loans in a fixed interest portfolio. Those are legitimate assets which can improve expected returns and risks, if used properly. The point is those return enhancing fixed interest assets have different risk drivers.

Asset owners should not be surprised when a portfolio with significant credit exposures behave differently from a portfolio of developed market sovereign bond at a time of market dislocation. In particular, capital market history suggests that a period of capital market tranquillity never last forever and something will break at some point.

Finally, I want to briefly comment on fixed interest managers’ ability to generate excess returns relevant to benchmark. Many investors and intermediaries appear to be sceptical on active fixed interest managers’ ability to generate “alpha”. In my experience, this view is not justified.

Yes, I concede that some of the perceived alpha is generated via taking credit, complexity and liquidity risk. However, my own experience suggests that after taking into account those factor risks, fixed interest managers can generate alpha more consistently than most active managers in other listed asset classes.

In fact, the post management fees, risk-adjusted return for fixed interest managers is superior to active managers in most asset classes. This is due to a combination of fixed interest managers offering more competitive fees, the existence of large non-profit maximising investors and the wide spread use of derivatives in fixed interest markets . However, there is one important caveat – investor need to properly understand and manage the risks which fixed interest managers assume in generating returns.

George Lin is an experienced strategist and investor in fixed interest and alternatives. He worked for Colonial First State for 17 years and in his most recent role was a Senior Investment Manager.

__________

[i3] Insights is the official educational bulletin of the Investment Innovation Institute [i3]. It covers major trends and innovations in institutional investing, providing independent and thought-provoking content about pension funds, insurance companies and sovereign wealth funds across the globe.