Convertible bond issuance reached record levels after markets recovered from the shock of the pandemic. We speak to Aviva’s Rico Pedrett about opportunities in the market and the impact of Your Future, Your Super on the asset class.

From a societal perspective the coronavirus pandemic is a key event that will go into the history books as a significant disruptor of modern life and will be picked apart and analysed by sociologists, historians and medical scientists alike for years to come.

But from a market perspective it now almost seems like a blip.

Equity markets especially showed an almost improbably quick recovery and have since kept on climbing.

But while equity markets all but ignored the biggest health crisis since the Spanish flu, companies, of course, have been faced with a very different reality.

There were those who were significantly hit by the extended lockdowns imposed by governments around the world, while others saw a dramatic increase in demand for their products and services as people moved to working from home.

Convertible bonds are typically done very quickly and, therefore, convertibles are usually the last source of funding that is available to companies when markets get really shaky and it is usually the first source of funding that becomes available again when markets reopen after a dislocation

Whether losers or winners from the pandemic, both types of companies needed funding, either in the form of rescue capital or to finance expansion.

The issue is that raising capital at the end of a period of market disruption is costly, whether it is through a straight debt raising or stock issuance.

In fact, the cheapest way to do it is to issue a convertible bond.

“The relatively light documentation of convertible bonds offers issuers very quick access to capital,” Rico Pedrett, Investment Director at Aviva Investors and a veteran of the convertible bond sector, says in an interview with [i3] Insights.

“It takes much less time to issue a convertible bond compared to raising equity, or to setting up a bond program, where issuers typically need to get a rating.

“So convertible bonds are typically done very quickly and, therefore, convertibles are usually the last source of funding that is available to companies when markets get really shaky and it is usually the first source of funding that becomes available again when markets reopen after a dislocation.”

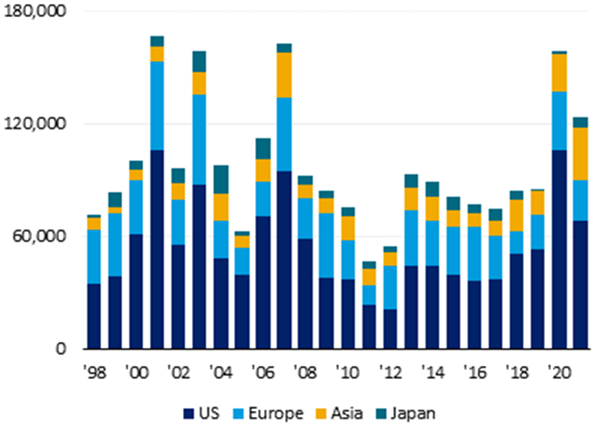

Unsurprisingly, 2020 turned out to be a stellar year for convertible bond issuance. Annual global issuance aggregates last year were at a level not seen since 2007, and 2021 is shaping up to be a good year for issuance too.

Pedrett says: “2020 was pretty much a record year and even the 2021 run rate is pretty much on track in the first nine or 10 months compared to the 2020 issuance levels. Now, while this momentum may not carry on forever, it has certainly rebased the convertible market.

“The asset class has probably grown by about 50 per cent in size compared to where it was two years ago and this opportunity set is here to stay for several years because these instruments tend to have a four, five or six-year tenure.

“You’ve had that first wave of issuance starting in April, May [2020] probably due to some balance sheet repairs and maybe some finances that have been postponed or put off. Then you had companies who came to markets as probably the winners of the stay-at-home economy and who needed capital to grow quickly.”

2020 was pretty much a record year and even the 2021 run rate is pretty much on track in the first nine or 10 months compared to the 2020 issuance levels. Now, while this momentum may not carry on forever, it has certainly rebased the convertible market

He gives the example of a heavily dislocated sector last year: cruise liners. Carnival Corporation was looking to raise capital to improve its capital position as cruise ships had become a focal point of outbreaks and were banned in many ports around the world. But issuing a bond would have been complicated, he says.

“It is probably one of the hardest-hit sectors and it would have been nearly impossible to come up with a price where investors would have been willing to put their money down to buy straight bonds. But by issuing a convertible bond, the company offered investors the possibility to participate in the equity upside in case of a recovery post dislocation,” he says.

He says the combination of low interest rates and the shock of the pandemic has led to a renaissance in the convertible bond market that will have long-lasting effects on the sector.

“If you allow me a very casual observation, the playground in which we now operate is a lot more attractive compared to where it was two years ago. It is bigger, it is more diverse and it is attractively priced,” he says.

Playing Defence

The relative complexity and relatively light documentation nature of the convertible bond sector mean it is a market that is almost exclusively accessed by institutional investors. For these investors, pricing is not the only attraction to buy into convertible bonds, but it is also the defensive qualities of these bonds.

Since convertible bonds offer investors the option to convert the bond into equity at a certain share price level, convertible bonds offer both upside participation and downside protection. This feature has been especially attractive in the recent period of market stress, while it also helps performance at the current low level of interest rates.

To ensure both qualities are preserved in the bonds, Pedrett highlights that the portfolio management team target the so-called balanced part of the market, which in practice means they target an equity sensitivity, or delta, of between 30 and 80 per cent.

“We exclude bonds that are very far out of the money because they don’t offer upside participation and we don’t buy convertible bonds that are very deeply in the money because they lose their characteristics that offer downside protection,” he says.

Tesla has been a regular issuer of convertible bonds and it is a name we used to own in our portfolio. But then [the Tesla share price] rallied so much that we sold out of the position even before it was taken out of the benchmark. The delta just kept creeping up and the bonds did fantastically well, but they just did not offer any downside protection anymore and no longer met our investment criteria. In our view, you might as well have just bought the stock

“Besides, the asymmetry of convertible bonds allows investors to capture more upside than downside and we feel the best way to express that target is to buy balanced convertible bonds. So by the time these instruments end up being converted [into equity] closer to maturity, we will already have sold them and reinvested in balanced convertible bonds.”

He gives the example of Tesla convertibles, which the team previously owned in the portfolio.

“Tesla has been a regular issuer of convertible bonds and it is a name we used to own in our portfolio. But then [the Tesla share price] rallied so much that we sold out of the position even before it was taken out of the benchmark,” he says.

“The delta just kept creeping up and the bonds did fantastically well, but they just did not offer any downside protection anymore and no longer met our investment criteria. In our view, you might as well have just bought the stock.”

No Interest?

Convertible bonds are a combination of bond and equity as the bond includes an option to buy the stock at a certain price. As an investor you seemingly get the best of both worlds as you own an income-generating asset with the potential of upside participation through the stock price.

It may, therefore, seem surprising Pedrett and his team hold several convertible bonds that have a coupon of zero. But he says zero coupon bonds are not necessarily unattractive.

“The fact that a bond has zero coupon does not mean that it is not an attractive proposition because a significant portion of convertible bond returns, typically about 50 per cent, come from equity appreciation,” he says.

“The equity price is by far the biggest driver of convertible returns and in order to generate alpha, stock-picking ability is imperative.”

He gives the example of SolarEdge, which issued a zero coupon convertible bond in 2020, maturing on 15 September 2025. Aviva’s convertible bond team bought the bond at the date of issuance.

“This company has many attractive qualities,” Pedrett explains.

SolarEdge is a renewable energy equipment provider and its business is focused on the hardware that is installed behind the solar panel that helps optimise, monitor and balance a solar system.

“SolarEdge is the leading supplier in this fast-growing market and is also a key solutions provider to addressing climate change, which aligns with our ESG framework,” Pedrett says.

The solar inverters market is dominated by two players, SolarEdge and Enphase Energy, which has created an oligopolistic-type market. Both companies have strong intellectual property around their solutions and have created significant barriers to entry to the business.

“SolarEdge’s balance sheet is stellar. With over US$1billion in cash and nicely free cash-flow positive, the company has the wherewithal to invest into the new verticals and expand with the rapidly growing end market,” Pedrett says.

“The SolarEdge convertible bonds were modelled as fair value at the time of issuance, but given the above dynamics we participated in the deal to establish a position in a company we felt had the opportunity to see its stock price revalue higher as they executed on their growth strategy.”

The scenario played out as hoped and SolarEdge’s share price has increased substantially since the issuance of the convertible bond in September last year. The bond was able to capture about 57 per cent of the upside, between September 2020 and November 2021, but at a significantly lower level of volatility.

Your Future, Your Super

In the past, institutional investors struggled with how to deal with convertible bonds in the context of a multi-asset portfolio as these bonds don’t seem to fit nicely in any particular asset bucket. Is it a stock or a bond?

Today, most investors are comfortable to simply classify these instruments as alternative assets, either as part of an opportunistic allocation or as part of a longer-term strategy.

But with the Your Future, Your Super legislation coming into force in Australia, investors have been confronted with a new and narrower definition of what an alternative asset should be.

Under the legislation, assets labelled as alternatives will be measured against a composite benchmark that consists of 50 per cent international equities and 50 per cent fixed income.

Considering convertible bonds straddle both asset classes, Aviva decided to compare the asset class against the benchmark used by the Australian Prudential Regulation Authority (APRA) and plotted the performance of the Refinitiv Global Focus Index against a composite index consisting of 50 per cent MSCI ACWI and 50 per cent Bloomberg Barclays Global Aggregate over a period of eight years.

The result shows convertible bonds keep a surprisingly close pace with the prudential regulator’s composite index.

Pedrett says the results could be explained by the performance drivers of convertible bonds.

“Among the drivers of convertible performance, not just over this eight-year period but generally, you can attribute about 50 per cent or so to equities and we believe that premise will hold firm whether equity markets go up or whether they will go down,” he says.

“Then you have maybe 30 per cent of performance coming from credit and then you have the rest coming from things like rates and volatility. So we believe that is why, conceptually, it is not a huge leap to say that convertible bonds belong in an alternative bucket as measured by APRA.”

Although further analysis is being conducted, Pedrett is positive the correlation is not coincidental and might hold going forward.

“Without having a huge numerical set of evidence to support this, I would think [it will hold up]. If you consider the period that we’re looking at, it has been a period where markets have gone in one direction with very few setbacks. Equity markets have only gone up, while spreads have only compressed,” he says.

“Now, this will not go on forever, but you would expect that the APRA benchmark will continue to have a relatively high correlation to equities.”

He also thinks convertible bonds will hold up relatively well if interest rates start to rise in a more structural way.

“In rising rates environments, convertible bonds offer a unique ability to protect real returns, not only thanks to the embedded equity exposure but also thanks to the relatively short duration compared to other fixed income asset classes. Historically, convertibles have correlated more closely with equity returns than any fixed income asset types – providing an excellent risk-mitigation strategy through diversification,” he says.

According to Pedrett, convertible bonds also tend to do well in periods of inflationary pressure, not the least because of the issuer composition in the asset class.

“Because there is a tilt towards companies that are experiencing relatively high growth, the underlying equities often have an ability to ‘outgrow’ inflation to a certain extent. Now, of course, if inflation and inflation expectations spiral out of control, that thesis will no longer hold,” he says.

“But I think if that happens, we may have different problems altogether.”

This article is sponsored by Aviva Investors. As such, the sponsor may suggest topics for consideration, but the Investment Innovation Institute [i3] will have final control over the content.

__________

[i3] Insights is the official educational bulletin of the Investment Innovation Institute [i3]. It covers major trends and innovations in institutional investing, providing independent and thought-provoking content about pension funds, insurance companies and sovereign wealth funds across the globe.