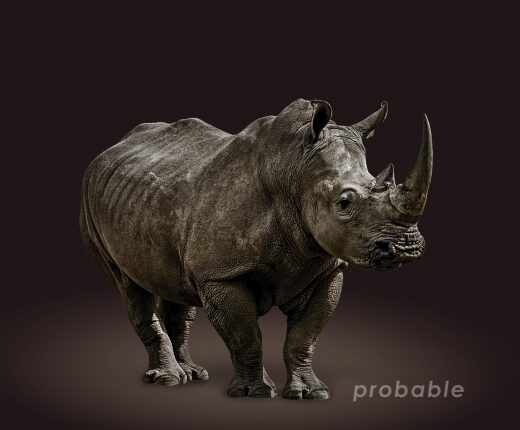

Of Unicorns and Rhinos

Marco Polo believed in unicorns and went looking for them in his trips to Asia. When he finally came across an animal that fitted his conception of having a horn on his head – a rhinoceros – he was bound by his paradigm and convinced that the mystical animal was sighted.

To accuse him of lying is probably not a fair statement. He merely over-relied on the consensus construct of information and available data.

Paradigms and methodologies can be very effective tools to use, however we run the risk of being constrained by the context.

Knowns and Unknowns

Nassim Taleb’s concept of ‘black swans’, highlighting the impact of highly improbable but impactful events, gained popularity after the global financial crisis of 2007-2008. Whilst it has drawn attention to the limitations of models and encouraged counter-factual thinking, one wonders if we might just be too engrossed with the search for unknown unknown’s.

Michele Wucker’s concept of the ‘gray rhino’ seems to bring some sense to the thinking. She defines it as a highly probable, high impact yet neglected threat: “Gray rhinos are not random surprises, but occur after a series of warnings and visible evidence”.

Communicating Uncertainty

There is no shortage of commentary and forecasting on the state of the markets, both short and long term. Coupled with increasing complexity and behavioural biases, CIOs making asset allocation decisions face the unenviable task of communicating such uncertainties to their stakeholders.

- Is this time really different? Is this the new normal?

- How will the QE (quantitative easing) to QT (quantitative tightening) narrative play out?

- How will the fragility of the geo-political landscape and impending trade wars impact markets?

- Are inflationary forces back, or are they disrupted by technological innovation?

Building Robustness

The breakdown in correlation between debt and equities has raised doubts about the efficacy of traditional asset allocation approaches. While there is consensus that the static 70/30 or 60/40 balanced portfolio has significant flaws, the jury is out in terms of suitable alternative models.

- The market euphoria, tainted by recent volatility, has only reinforced the need to build defensiveness into the portfolio. Deploying alternatives should make sense.

- Diversification using risk factors has gained increasing acceptance as additional levers for portfolio construction. This feeds into the ‘active versus passive’ discussion, where the fees and value-for-money proposition remain contentious.

- Beyond the public markets, the role of unlisted assets in the portfolio also deserve some attention, notwithstanding the challenges of fees and illiquidity.

- Active ownership and ESG considerations have become mainstream, though effective implementation remains an on-going challenge.

Making Decisions Under Uncertainty

The 7th annual Asset Allocation Forum will emphasise the essence of making investment decisions in the midst of market uncertainty, utilising a case study approach supplemented by presentations and discussions.

Enquire about this event