Insurance investing was meant to be a relatively uneventful endeavour. With low appetite for risky assets and strict regulations, insurance companies have historically invested mostly in fixed income.

But as interest rates fell, the calls for diversification started to ring louder.

And now, in 2022, insurance companies not only face low interest rates, but also rising inflation, large-scale business disruptions from the COVID-19 pandemic, both internally and among customers, and more severe weather events, including major flooding in parts of NSW.

How to play a defensive game in this environment?

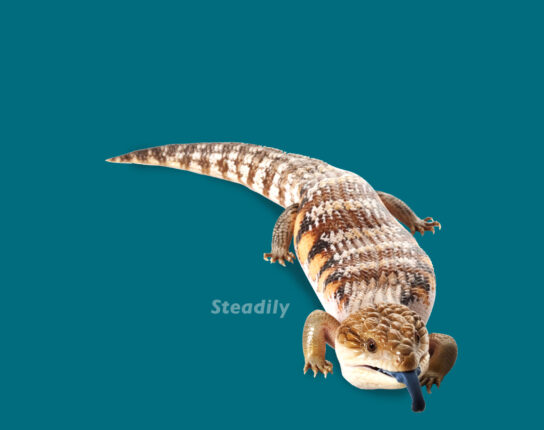

Perhaps we can take a leaf out of the book of the blue-tongue lizard.

Although most large reptiles are only found in patches of remaining bushland, the blue-tongued lizard remains abundant throughout residential areas.

Yet, the blue-tongue lizard’s defences consist largely of flattening its body to appear larger and sticking out its iconic blue tongue, hardly anything lethal.

So how has this large, and often slow-moving reptile managed to survive in the suburbs?

Researchers have found that these creatures use an intricate network of corridors, consisting of dense vegetation to move between safe sites, and actively avoid perils such as crossing roads.

Blue-tongue lizards also show loyalty to their domain, spending up to 70 per cent of their time in safe havens. Finally, they limit the time they move around to those periods when they are least likely to encounter humans or pets.

These lizards display patience, they stick to what they know and they don’t take excessive risk.

‘Slow and steady wins the race’ seems to be their motto.

We can see some clear parallels here with insurance investors, but what makes up the slow and steady approach in the current environment?

Now in its 10th year, the [i3] Insurance Investment Forum will address the following issues:

- How to rebuild thoughtful asset allocations after the turmoil of the pandemic?

- How do we position portfolios for higher inflation?

- How can we balance defensiveness and diversification?

- Do private markets offer a solution, or are we all chasing the same assets?

We hope to see you on the 15th of June to discuss this and more.

Enquire about this event