Unisuper has grown to $115 billion in assets under management and 620,000 members after completing the merger with Australian Catholic Superannuation

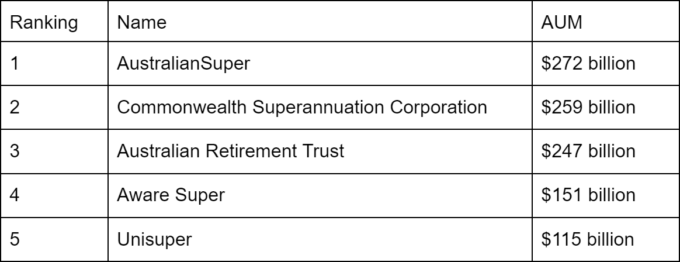

Unisuper has grown to $115 billion in assets under management and 620,000 members after completing the merger with Australian Catholic Superannuation (ACS), making it the fifth largest superannuation fund in Australia, based on the Australian Prudential Regulation Authority (APRA)’s annual fund-level superannuation statistics of 2022, published today.

Last year, it was still the eighth largest fund in Australia, behind N.M. Superannuation Proprietary (AMP), MLC (Nulis Nominees) and BT Super.

Unisuper and ACS announced last week to have completed the execution of the successor fund transfer (SFT) with more than 80,000 former ACS members joining UniSuper.

Source: APRA Annual Fund-level Superannuation Statistics 2022

“We’re really pleased to welcome members formerly from ACS to UniSuper,” Peter Chun, Chief Executive Officer of Unisuper said.

“Scale offers opportunities for the fund, keeping downward pressure on fees, ensuring that UniSuper can continue to leverage our position as an active investor, and unlocking investment opportunities that simply aren’t available to smaller funds.

“All of these factors position UniSuper to continue serving our members’ best financial interests.”

Scale offers opportunities for the fund, keeping downward pressure on fees, ensuring that UniSuper can continue to leverage our position as an active investor, and unlocking investment opportunities that simply aren’t available to smaller funds

Consolidation of the superannuation industry has accelerated in recent years, partly due to the vocal support of APRA for fewer funds.

Although APRA cannot force a fund to merge since it is a prudential regulator, it has proven to be an influential voice in recent mergers.

The regulator hasn’t put an explicit minimum on fund size, but research conducted by APRA earlier this year concluded that most superannuation funds with assets under management of less than $10 billion were facing sustainability issues, as they were experiencing declining cash flows and member accounts, while charging higher fees than funds with assets over $50 billion.

Even small to medium-sized funds, those with assets between $10 billion and $50 billion, were struggling, the regulator said.

Greg Cantor, former Chief Executive Officer of ACS, said he was pleased to have found in Unisuper a merger partner that was culturally aligned with ACS’ members.

“Our mission has always been to enable the best retirement outcomes possible for our members. After considerable due diligence, I am confident this merger delivers on that goal for our members,” he said.

“We have been very pleased with the cultural alignment of our fund with that of UniSuper and their commitment to work closely with our members and employers in Catholic agencies and Catholic schools.”

__________

[i3] Insights is the official educational bulletin of the Investment Innovation Institute [i3]. It covers major trends and innovations in institutional investing, providing independent and thought-provoking content about pension funds, insurance companies and sovereign wealth funds across the globe.